Convergence Theory

We have seen how the economies of some capitalist countries such as the United States have features that are very similar to socialism. Some industries, particularly utilities, are either owned by the government or controlled through regulations. Public programs such as welfare, Medicare, and Social Security exist to provide public funds for private needs. We have also seen how several large communist (or formerly communist) countries such as Russia, China, and Vietnam have moved from state-controlled socialism with central planning to market socialism, which allows market forces to dictate prices and wages and for some business to be privately owned. In many formerly communist countries, these changes have led to economic growth compared to the stagnation they experienced under communism (Fidrmuc 2002).

In studying the economies of developing countries to see if they go through the same stages as previously developed nations did, sociologists have observed a pattern they call convergence. This describes the theory that societies move toward similarity over time as their economies develop.

Convergence theory explains that as a country’s economy grows, its societal organization changes to become more like that of an industrialized society. Rather than staying in one job for a lifetime, people begin to move from job to job as conditions improve and opportunities arise. This means the workforce needs continual training and retraining. Workers move from rural areas to cities as they become centers of economic activity, and the government takes a larger role in providing expanded public services (Kerr et al. 1960).

Supporters of the theory point to Germany, France, and Japan—countries that rapidly rebuilt their economies after World War II. They point out how, in the 1960s and 1970s, East Asian countries like Singapore, South Korea, and Taiwan converged with countries with developed economies. They are now considered developed countries themselves.

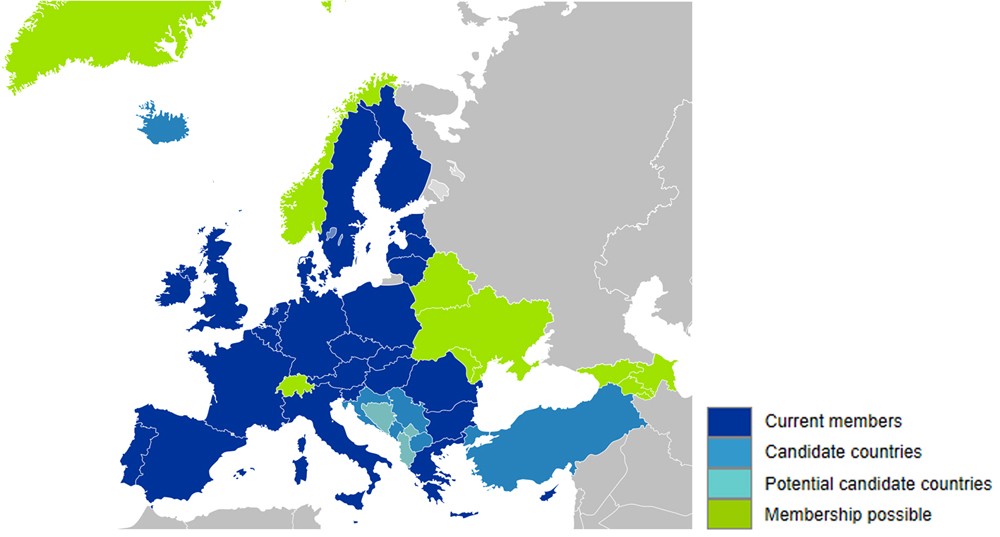

Sociologists look for signs of convergence and divergence in the societies of countries that have joined the European Union. (Map courtesy of the European Union)

To experience this rapid growth, the economies of developing countries must to be able to attract inexpensive capital to invest in new businesses and to improve traditionally low productivity. They need access to new, international markets for buying the goods. If these characteristics are not in place, then their economies cannot catch up. This is why the economies of some countries are diverging rather than converging (Abramovitz 1986).

Another key characteristic of economic growth regards the implementation of technology. A developing country can bypass some steps of implementing technology that other nations faced earlier. Television and telephone systems are a good example. While developed countries spent significant time and money establishing elaborate system infrastructures based on metal wires or fiber-optic cables, developing countries today can go directly to cell phone and satellite transmission with much less investment.

Another factor affects convergence concerning social structure. Early in their development, countries such as Brazil and Cuba had economies based on cash crops (coffee or sugarcane, for instance) grown on large plantations by unskilled workers. The elite ran the plantations and the government, with little interest in training and educating the populace for other endeavors. This restricted economic growth until the power of the wealthy plantation owners was challenged (Sokoloff and Engerman 2000). Improved economies generally lead to wider social improvement. Society benefits from improved educational systems and allowed people more time to devote to learning and leisure.

Theoretical Perspectives on the Economy

Now that we’ve developed an understanding of the history and basic components of economies, let’s turn to theory. How might social scientists study these topics? What questions do they ask? What theories do they develop to add to the body of sociological knowledge?

Functionalist Perspective

Someone taking a functional perspective will most likely view work and the economy as a well-oiled machine that is designed for maximum efficiency. The Davis-Moore thesis, for example, suggests that some social stratification is a social necessity. The need for certain highly skilled positions combined with the relative difficulty of the occupation and the length of time it takes to qualify will result in a higher reward for that job and will provide a financial motivation to engage in more education and a more difficult profession (Davis and Moore 1945). This theory can be used to explain the prestige and salaries that go with careers only available to those with doctorates or medical degrees.

The functionalist perspective would assume that the continued health of the economy is vital to the health of the nation, as it ensures the distribution of goods and services. For example, we need food to travel from farms (high-functioning and efficient agricultural systems) via roads (safe and effective trucking and rail routes) to urban centers (high-density areas where workers can gather). However, sometimes a dysfunction––a function with the potential to disrupt social institutions or organization (Merton 1968)––in the economy occurs, usually because some institutions fail to adapt quickly enough to changing social conditions. This lesson has been driven home recently with the bursting of the housing bubble. Due to risky lending practices and an underregulated financial market, we are recovering from the after-effects of the Great Recession, which Merton would likely describe as a major dysfunction.

Some of this is cyclical. Markets produce goods as they are supposed to, but eventually the market is saturated and the supply of goods exceeds the demands. Typically the market goes through phases of surplus, or excess, inflation, where the money in your pocket today buys less than it did yesterday, and recession, which occurs when there are two or more consecutive quarters of economic decline. The functionalist would say to let market forces fluctuate in a cycle through these stages. In reality, to control the risk of an economic depression (a sustained recession across several economic sectors), the U.S. government will often adjust interest rates to encourage more lending—and consequently more spending. In short, letting the natural cycle fluctuate is not a gamble most governments are willing to take.

Conflict Perspective

For a conflict perspective theorist, the economy is not a source of stability for society. Instead, the economy reflects and reproduces economic inequality, particularly in a capitalist marketplace. The conflict perspective is classically Marxist, with the bourgeoisie (ruling class) accumulating wealth and power by exploiting and perhaps oppressing the proletariat (workers), and regulating those who cannot work (the aged, the infirm) into the great mass of unemployed (Marx and Engels 1848). From the symbolic (though probably made up) statement of Marie Antoinette, who purportedly said, “Let them eat cake” when told that the peasants were starving, to the Occupy Wall Street movement that began during the Great Recession, the sense of inequity is almost unchanged. Conflict theorists believe wealth is concentrated in the hands of those who do not deserve it. As of 2010, 20 percent of Americans owned 90 percent of U.S. wealth (Domhoff 2014). While the inequality might not be as extreme as in pre-revolutionary France, it is enough to make many believe that the United States is not the meritocracy it seems to be.

Symbolic Interactionist Perspective

Those working in the symbolic interaction perspective take a microanalytical view of society. They focus on the way reality is socially constructed through day-to-day interaction and how society is composed of people communicating based on a shared understanding of symbols.

One important symbolic interactionist concept related to work and the economy is career inheritance. This concept means simply that children tend to enter the same or similar occupation as their parents, which is a correlation that has been demonstrated in research studies (Antony 1998). For example, the children of police officers learn the norms and values that will help them succeed in law enforcement, and since they have a model career path to follow, they may find law enforcement even more attractive. Related to career inheritance is career socialization—learning the norms and values of a particular job.

Finally, a symbolic interactionist might study what contributes to job satisfaction. Melvin Kohn and his fellow researchers (1990) determined that workers were most likely to be happy when they believed they controlled some part of their work, when they felt they were part of the decision-making processes associated with their work, when they have freedom from surveillance, and when they felt integral to the outcome of their work. Sunyal, Sunyal, and Yasin (2011) found that a greater sense of vulnerability to stress, the more stress experienced by a worker, and a greater amount of perceived risk consistently predicted a lower worker job satisfaction.

Short Answer

- Describe the impact a rapidly growing economy can have on families.

- How do you think the United States economy will change as we move closer to a technology-driven service economy?

Practice

- Singapore

- North Korea

- England

- Canada

Self-Check: Economic Systems

You’ll have more success on the Self-Check, if you’ve completed the four Readings in this section.

Candela Citations

- Self-Check: Economic Systems. Authored by: Cathy Matresse and Lumen Learning. Provided by: Lumen Learning. License: CC BY: Attribution