What you’ll learn to do: explain the characteristics of monopolistic competition and how it differs from other market structures

Monopolistically competitive industries are those that contain more than a few firms, each of which offers a similar but not identical product. Take fast food, for example. The fast food market is quite competitive, and yet each firm has a monopoly in its own product. Some customers have a preference for McDonald’s over Burger King. Some have a preference for Dominoes over Pizza Hut. These preferences give monopolistically competitive firms market power, which they can exploit to earn positive economic profits.

Consider the following questions:

- Why do gas stations charge different prices for a gallon of gasoline?

- What determines how far apart the prices of Colgate and Crest toothpaste can be?

- Why did fast food restaurants start offering salads?

- Why are fast food chicken sandwich prices different from burger prices?

- Why did McDonalds come up with the Big Mac sandwich?

- Describe and give examples of monopolistically competitive industries

- Explain the significance of differentiated products to monopolistic competition

- Compare demand curves for monopolistically competitive firms, monopolies, and perfectly competitive firms

Monopolistic Competition

Monopolistic competition is what economists call industries that consist of many firms competing against each other, but selling products that are distinctive in some way. Examples include stores that sell different styles of clothing; restaurants or grocery stores that sell different kinds of food; and even products like golf balls or beer that may be at least somewhat similar but differ in public perception because of advertising and brand names. When products are distinctive, each firm has a mini-monopoly on its particular style or flavor or brand name. However, firms producing such products must also compete with other styles and flavors and brand names. The term “monopolistic competition” captures this mixture of mini-monopoly and tough competition.

Who invented the theory of imperfect competition?

The theory of imperfect competition was developed by two economists independently but simultaneously in 1933. The first was Edward Chamberlin of Harvard University who published The Economics of Monopolistic Competition. The second was Joan Robinson of Cambridge University who published The Economics of Imperfect Competition. Robinson subsequently became interested in macroeconomics where she became a prominent Keynesian, and later a post-Keynesian economist.

Try It

Differentiated Products

A firm can try to make its products different from those of its competitors in several ways: physical characteristics of the product, location from which the product is sold, intangible aspects of the product, and perceptions of the product. Products that are distinctive in these ways are called differentiated products.

Physical characteristics of a product include all the phrases you hear in advertisements: unbreakable bottle, nonstick surface, freezer-to-microwave, non-shrink, extra spicy, newly redesigned for your comfort. The location of a firm can also create a difference between producers. For example, a gas station located at a heavily traveled intersection is more convenient than one on a less-traveled back road. A supplier to an automobile manufacturer may find that it is an advantage to locate close to the car factory.

Intangible aspects can differentiate a product, too. Some intangible aspects may be promises like a guarantee of satisfaction or money back, a reputation for high quality, services like free delivery, or offering a loan to purchase the product. Finally, product differentiation may occur in the minds of buyers. For example, many people could not tell the difference in taste between common varieties of beer or cigarettes if they were blindfolded but, because of past habits and advertising, they have strong preferences for certain brands. Advertising can play a role in shaping these intangible preferences.

The concept of differentiated products is closely related to the degree of variety that is available. If everyone in the economy wore only blue jeans, ate only white bread, and drank only tap water, then the markets for clothing, food, and drink would be much closer to perfectly competitive. The variety of styles, flavors, locations, and characteristics creates product differentiation and monopolistic competition.

Try It

Perceived Demand for a Monopolistic Competitor

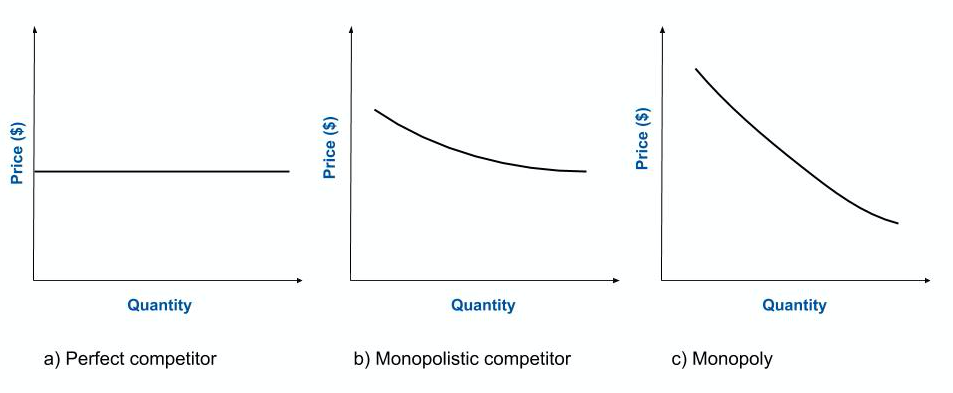

A monopolistically competitive firm perceives a demand for its goods that is an intermediate case between monopoly and competition. Figure 1 offers a reminder that the demand curve as faced by a perfectly competitive firm is perfectly elastic or flat, because the perfectly competitive firm can sell any quantity it wishes at the prevailing market price. In contrast, the demand curve, as faced by a monopolist, is the market demand curve, since a monopolist is the only firm in the market, and hence is downward sloping.

Figure 1. Perceived Demand for Firms in Different Competitive Settings. The demand curve faced by a perfectly competitive firm is perfectly elastic, meaning it can sell all the output it wishes at the prevailing market price. The demand curve faced by a monopoly is the market demand. It can sell more output only by decreasing the price it charges. The demand curve faced by a monopolistically competitive firm falls in between.

The demand curve as faced by a monopolistic competitor is not flat, but rather downward-sloping, which means that the monopolistic competitor can raise its price without losing all of its customers or lower the price and gain more customers. Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than that of a monopoly where there are no close substitutes. If a monopolist raises its price, some consumers will choose not to purchase its product—but they will then need to buy a completely different product. However, when a monopolistic competitor raises its price, some consumers will choose not to purchase the product at all, but others will choose to buy a similar product from another firm. If a monopolistic competitor raises its price, it will not lose as many customers as would a perfectly competitive firm, but it will lose more customers than would a monopoly that raised its prices.

At a glance, the demand curves faced by a monopoly and by a monopolistic competitor look similar—that is, they both slope down. But the underlying economic meaning of these perceived demand curves is different, because a monopolist faces the market demand curve and a monopolistic competitor does not. Rather, a monopolistically competitive firm’s demand curve is but one of many firms that make up the “before” market demand curve. Are you following? If so, how would you categorize the market for golf balls?

Try It

ARE GOLF BALLS REALLY DIFFERENTIATED PRODUCTS?

Monopolistic competition refers to an industry that has more than a few firms, each offering a product which, from the consumer’s perspective, is different from its competitors. The U.S. Golf Association runs a laboratory that tests 20,000 golf balls a year. There are strict rules for what makes a golf ball legal. The weight of a golf ball cannot exceed 1.620 ounces and its diameter cannot be less than 1.680 inches (which is a weight of 45.93 grams and a diameter of 42.67 millimeters, in case you were wondering). The balls are also tested by being hit at different speeds. For example, the distance test involves having a mechanical golfer hit the ball with a titanium driver and a swing speed of 120 miles per hour. As the testing center explains: “The USGA system then uses an array of sensors that accurately measure the flight of a golf ball during a short, indoor trajectory from a ball launcher. From this flight data, a computer calculates the lift and drag forces that are generated by the speed, spin, and dimple pattern of the ball. … The distance limit is 317 yards.”

Over 1800 golf balls made by more than 100 companies meet the USGA standards. The balls do differ in various ways, like the pattern of dimples on the ball, the types of plastic used on the cover and in the cores, and so on. Since all balls need to conform to the USGA tests, they are much more alike than different. In other words, golf ball manufacturers are monopolistically competitive.

However, retail sales of golf balls are about $500 million per year, which means that a lot of large companies have a powerful incentive to persuade players that golf balls are highly differentiated and that it makes a huge difference which one you choose. Sure, Tiger Woods can tell the difference. For the average duffer (golf-speak for a “mediocre player”) who plays a few times a summer—and who loses a lot of golf balls to the woods and lake and needs to buy new ones—most golf balls are pretty much indistinguishable.

Watch It

Watch this video for a brief overview of monopolistic competition and to see a comparison between perfect competition, monopolistic competition, and monopolies. The video goes on to explain the cost curves for a monopolistically competitive firm and how it compares to those in different competitive settings, which we’ll cover in more detail later in the module.

Glossary

- differentiated product:

- a product that is consumers perceive as distinctive in some way

- imperfectly competitive:

- firms and organizations that fall between the extremes of monopoly and perfect competition

- monopolistic competition:

- many firms competing to sell similar but differentiated products

- product differentiation:

- any action that firms do to make consumers think their products are different from their competitors’

Candela Citations

- Authored by: Steven Greenlaw and Lumen Learning. License: CC BY: Attribution

- Monopolistic Competition. Authored by: OpenStax College. Located at: https://cnx.org/contents/vEmOH-_p@4.44:gKktXtD8@6/Monopolistic-Competition. License: CC BY: Attribution. License Terms: Download for free at http://cnx.org/contents/bc498e1f-efe9-43a0-8dea-d3569ad09a82@4.44

- Episode 29: Monopolistic Competition. Authored by: Dr. Mary McGlasson. Located at: https://www.youtube.com/watch?v=T3F1Vt3IyNc&t=25s. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives