Money Creation

To understand the process of money creation today, let us create a hypothetical system of banks. We will focus on three banks in this system: Acme Bank, Bellville Bank, and Clarkston Bank. Assume that all banks are required to hold reserves equal to 10% of their checkable deposits. The quantity of reserves banks are required to hold is called required reserves. The reserve requirement is expressed as a required reserve ratio; it specifies the ratio of reserves to checkable deposits a bank must maintain. Banks may hold reserves in excess of the required level; such reserves are called excess reserves. Excess reserves plus required reserves equal total reserves.

Because banks earn relatively little interest on their reserves held on deposit with the Federal Reserve, we shall assume that they seek to hold no excess reserves. When a bank’s excess reserves equal zero, it is loaned up. Finally, we shall ignore assets other than reserves and loans and deposits other than checkable deposits. To simplify the analysis further, we shall suppose that banks have no net worth; their assets are equal to their liabilities.

Let us suppose that every bank in our imaginary system begins with $1,000 in reserves, $9,000 in loans outstanding, and $10,000 in checkable deposit balances held by customers. The balance sheet for one of these banks, Acme Bank, is shown in Table 9.2 “A Balance Sheet for Acme Bank.” The required reserve ratio is 0.1: Each bank must have reserves equal to 10% of its checkable deposits. Because reserves equal required reserves, excess reserves equal zero. Each bank is loaned up.

Table 9.2 A Balance Sheet for Acme Bank

| Acme Bank | |||

|---|---|---|---|

| Assets | Liabilities | ||

| Reserves | $1,000 | Deposits | $10,000 |

| Loans | $9,000 | ||

We assume that all banks in a hypothetical system of banks have $1,000 in reserves, $10,000 in checkable deposits, and $9,000 in loans. With a 10% reserve requirement, each bank is loaned up; it has zero excess reserves.

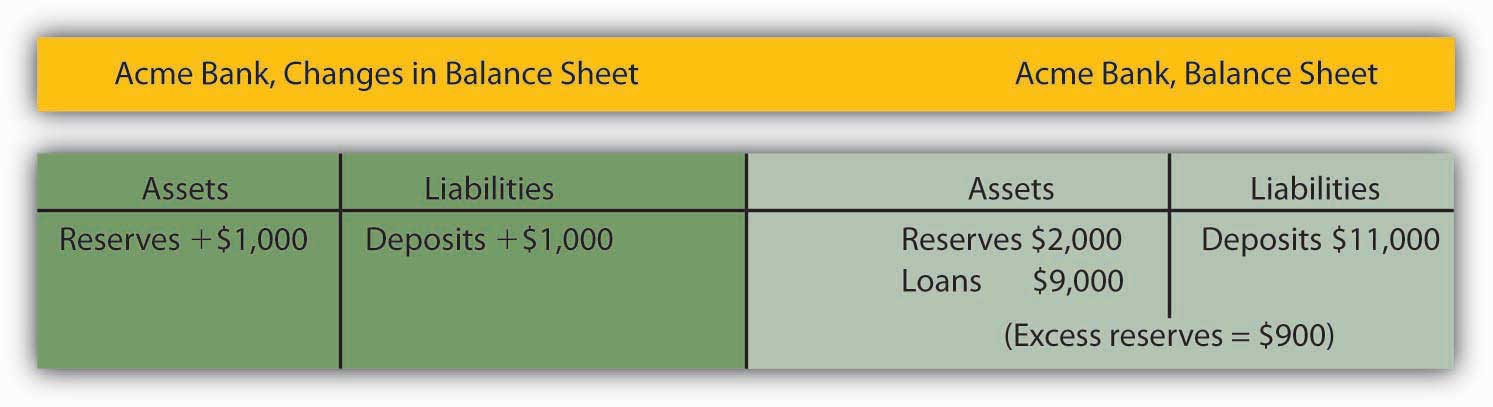

Acme Bank, like every other bank in our hypothetical system, initially holds reserves equal to the level of required reserves. Now suppose one of Acme Bank’s customers deposits $1,000 in cash in a checking account. The money goes into the bank’s vault and thus adds to reserves. The customer now has an additional $1,000 in his or her account. Two versions of Acme’s balance sheet are given here. The first shows the changes brought by the customer’s deposit: reserves and checkable deposits rise by $1,000. The second shows how these changes affect Acme’s balances. Reserves now equal $2,000 and checkable deposits equal $11,000. With checkable deposits of $11,000 and a 10% reserve requirement, Acme is required to hold reserves of $1,100. With reserves equaling $2,000, Acme has $900 in excess reserves.

At this stage, there has been no change in the money supply. When the customer brought in the $1,000 and Acme put the money in the vault, currency in circulation fell by $1,000. At the same time, the $1,000 was added to the customer’s checking account balance, so the money supply did not change.

Figure 9.3

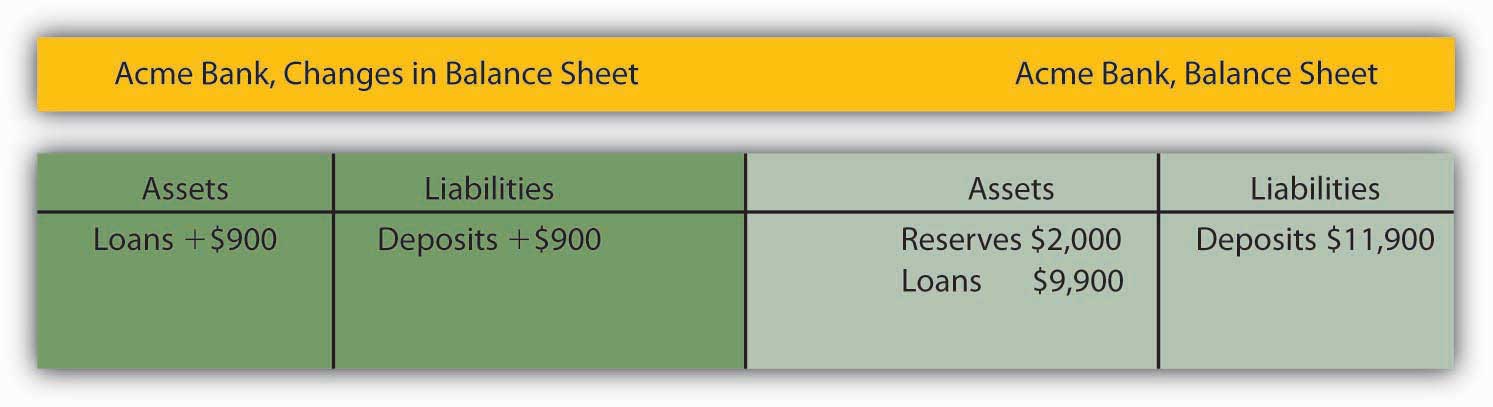

Because Acme earns only a low interest rate on its excess reserves, we assume it will try to loan them out. Suppose Acme lends the $900 to one of its customers. It will make the loan by crediting the customer’s checking account with $900. Acme’s outstanding loans and checkable deposits rise by $900. The $900 in checkable deposits is new money; Acme created it when it issued the $900 loan. Now you know where money comes from—it is created when a bank issues a loan.

Figure 9.4

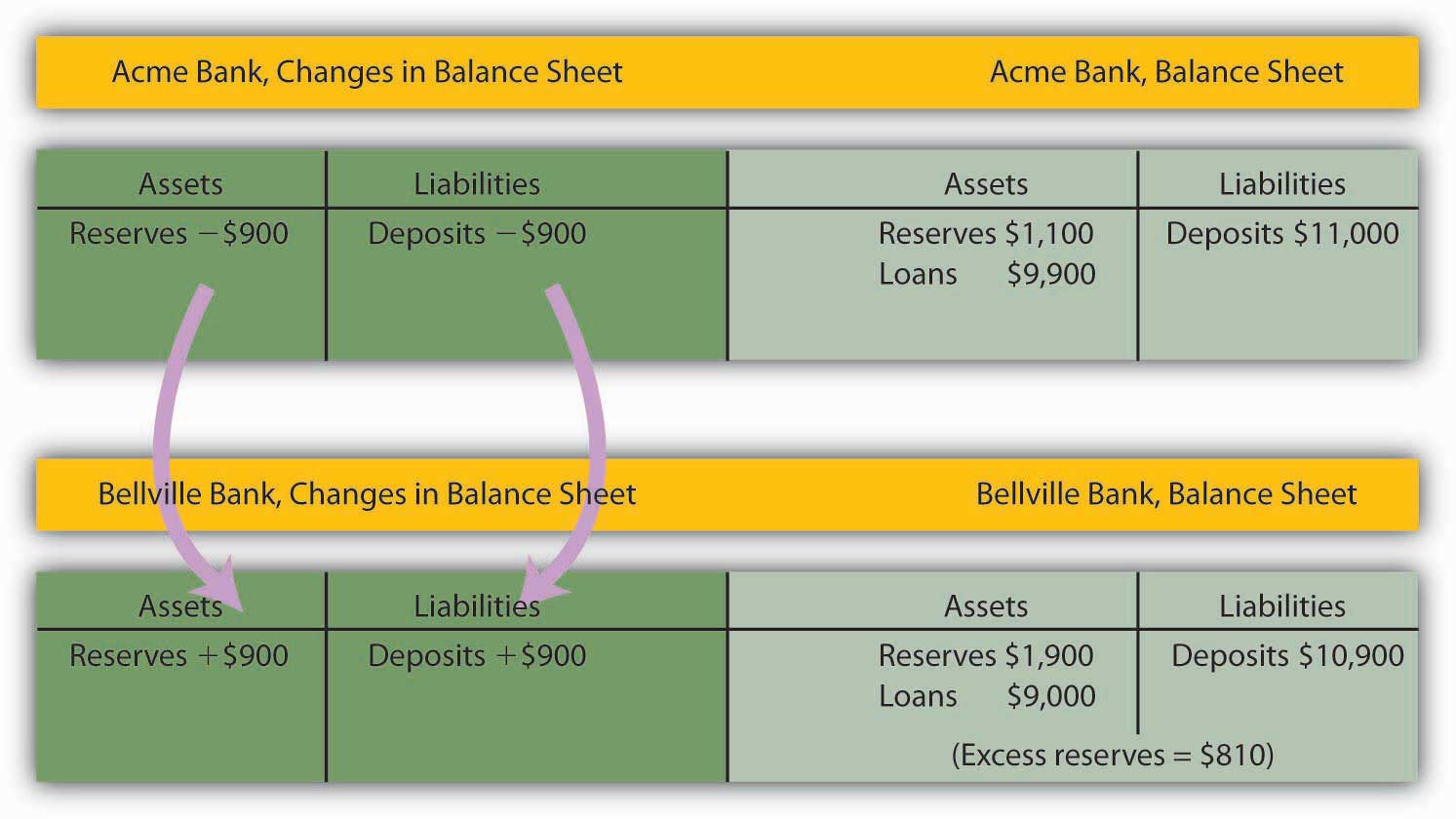

Presumably, the customer who borrowed the $900 did so in order to spend it. That customer will write a check to someone else, who is likely to bank at some other bank. Suppose that Acme’s borrower writes a check to a firm with an account at Bellville Bank. In this set of transactions, Acme’s checkable deposits fall by $900. The firm that receives the check deposits it in its account at Bellville Bank, increasing that bank’s checkable deposits by $900. Bellville Bank now has a check written on an Acme account. Bellville will submit the check to the Fed, which will reduce Acme’s deposits with the Fed—its reserves—by $900 and increase Bellville’s reserves by $900.

Figure 9.5

Notice that Acme Bank emerges from this round of transactions with $11,000 in checkable deposits and $1,100 in reserves. It has eliminated its excess reserves by issuing the loan for $900; Acme is now loaned up. Notice also that from Acme’s point of view, it has not created any money! It merely took in a $1,000 deposit and emerged from the process with $1,000 in additional checkable deposits.

Notice that when the banks received new deposits, they could make new loans only up to the amount of their excess reserves, not up to the amount of their deposits and total reserve increases. For example, with the new deposit of $1,000, Acme Bank was able to make additional loans of $900. If instead it made new loans equal to its increase in total reserves, then after the customers who received new loans wrote checks to others, its reserves would be less than the required amount. In the case of Acme, had it lent out an additional $1,000, after checks were written against the new loans, it would have been left with only $1,000 in reserves against $11,000 in deposits, for a reserve ratio of only 0.09, which is less than the required reserve ratio of 0.1 in the example.

Creating Money

Watch this video to review the process of how banks create money:

Self Check: Lending, Money, and Banks

Answer the question(s) below to see how well you understand the topics covered in the previous section. This short quiz does not count toward your grade in the class, and you can retake it an unlimited number of times.

You’ll have more success on the Self Check if you’ve completed the two Readings in this section.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.

Candela Citations

- Principles of Macroeconomics Chapter 9.2. Authored by: Anonymous. Located at: http://2012books.lardbucket.org/books/macroeconomics-principles-v1.0/s12-02-the-banking-system-and-money-c.html. License: CC BY-NC-SA: Attribution-NonCommercial-ShareAlike

- Video: (Macro) Episode 30: Creating Money. Authored by: Mary J. McGlasson. Located at: https://youtu.be/pZRvja7Mvrw?list=PLF2A3693D8481F442. License: CC BY-NC-ND: Attribution-NonCommercial-NoDerivatives