Learning Outcomes

- Identify controllable and noncontrollable costs

An effective responsibility accounting system provides information to evaluate each manager based on the revenue and expense items over which that manager has primary control (authority to influence).

For example, let’s say the manager of the Engineering and Maintenance department is in charge of making sure all of the machinery is in safe working condition, and so she oversees compliance with Occupational Safety and Health Administration (OSHA) regulations as well as general maintenance and makes suggestions for capital budgeting. A decline in sales revenue or an increase in administrative expenses would be outside of that manager’s sphere of control. Also, although it relates to equipment, depreciation expense would also not be a controllable item for the maintenance supervisor. However, penalties paid to OSHA are a direct indication of how well she is doing managing a significant part of her department. So is downtime on equipment, maintenance costs, and to some extent, parts and supplies budget for her department.

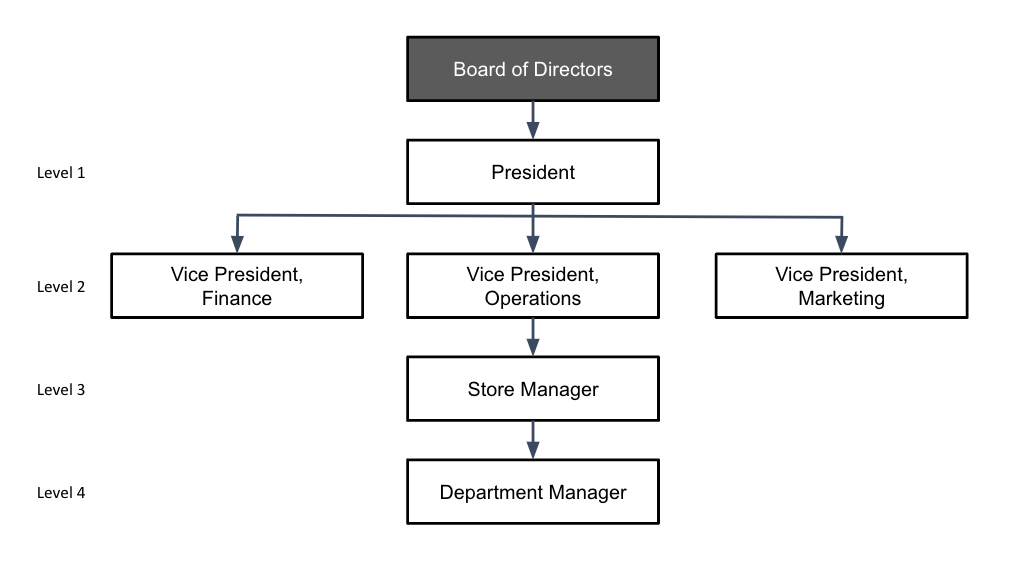

The manager’s level in the organization affects those items over which that manager has control. The president is usually considered a first-level manager. Managers (usually vice presidents) who report directly to the president are second-level managers. Notice on the organization chart that individuals at a specific management level are on a horizontal line across the chart. Not all managers at that level, however, necessarily have equal authority and responsibility. The degree of a manager’s authority varies from company to company.

While the president may delegate much decision-making power, some revenue and expense items remain exclusively under the president’s control. For example, in some companies, large capital (plant and equipment) expenditures may be approved only by the president. Therefore, depreciation, property taxes, and other related expenses should not be designated as a store manager’s responsibility since these costs are not primarily under that manager’s control.

The controllability criterion is crucial to the content of performance reports for each manager. For example, at the department supervisor level, perhaps only direct materials and direct labor cost control are appropriate for measuring performance. A plant manager, however, has the authority to make decisions regarding many other costs not controllable at the supervisory level, such as the salaries of department supervisors. These other costs would be included in the performance evaluation of the store manager, not the supervisor.

In short, controllable costs are things the executive, manager, or department even can control or change. If the executive, manager, or department cannot change or control the cost, it is a noncontrollable cost.

Here is a short video explanation of controllable and noncontrollable costs:

You can view the transcript for “Controllable and Uncontrollable costs” here (opens in new window).

Now, check your understanding of the definition and importance of controllable costs.

Practice Question

Candela Citations

- Controllable Costs. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Controllable and Uncontrollable costs. Provided by: Rutgers Accounting Web. Located at: https://youtu.be/HKJjov8i3RU. License: All Rights Reserved. License Terms: Standard YouTube License