Learning Outcomes

- Describe the flow of costs through a process costing system

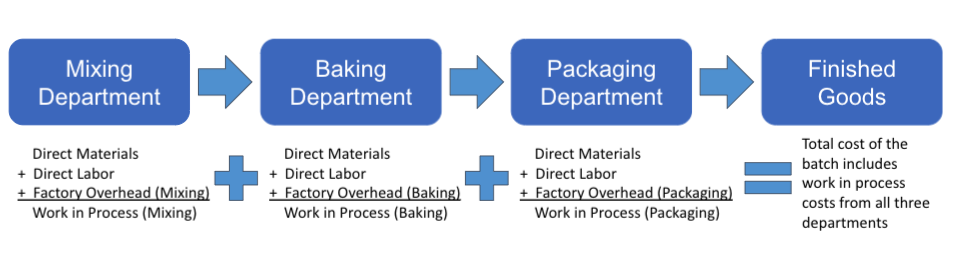

With process costing, products typically move from department to department in a “production line” format instead of the materials and labor coming to the product at one location (as is typically the case in job order costing, where each product is unique). Each department performs a different function and can be considered its own little business or mini-factory. As such, each department adds its own direct materials, direct labor, and factory overhead costs. These three costs accumulate in a departmental account called Work in Process – Department Name, which is like the “tab” of the manufactured item. There will be three debits to Work in Process for each department – one for direct materials, one for direct labor, and one for factory overhead.

As an example, a company manufactures 16” chocolate chip cookies similar to those in the cookie shops in the malls. The company’s factory has three departments: (1) Mixing, (2) Baking, and (3) Packaging. The products move through these departments in order: Mixing first, Baking next, and Packaging last. The process occurs on a FIFO (first in, first out) basis where the first batch started is the first one to be completed. The batch started behind the first batch is the next to be completed, and so forth. Each time the Mixing Department adds more ingredients, a new batch is introduced into the overall production line.

As an example, a company manufactures 16” chocolate chip cookies similar to those in the cookie shops in the malls. The company’s factory has three departments: (1) Mixing, (2) Baking, and (3) Packaging. The products move through these departments in order: Mixing first, Baking next, and Packaging last. The process occurs on a FIFO (first in, first out) basis where the first batch started is the first one to be completed. The batch started behind the first batch is the next to be completed, and so forth. Each time the Mixing Department adds more ingredients, a new batch is introduced into the overall production line.

Process costing involves recording product costs for each manufacturing department (or process) as the product moves through. Each department has its own Work in Process and Factory Overhead accounts that include the department names, as follows:

| Department | Work in Process account | Factory Overhead account |

| Mixing | Work in Process – Mixing | Factory Overhead – Mixing |

| Baking | Work in Process – Baking | Factory Overhead – Baking |

| Packaging | Work in Process – Packaging | Factory Overhead – Packaging |

The batch moves from one department to the next. Materials, labor, and factory overhead costs are added in each department. The sum of the departmental work in process costs is the total cost of the batch that is transferred to Finished Goods.

The diagram above shows the cost flows in a process cost system that processes the products in a specified sequential order. That is, the production and processing of products begin in the Mixing Department. From the Mixing Department, products go to the Baking Department. From the Baking Department, products go to the Packing Department. Each Department inputs direct materials and further processes the products. Then the Packaging Department transfers the products to Finished Goods Inventory.

Practice Question

Candela Citations

- Flow of Costs. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Principles of Managerial Accounting. Authored by: Christine Jonick. Located at: https://ung.edu/university-press/books/managerial-accounting.php. License: CC BY-SA: Attribution-ShareAlike

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution

- Chocolate chip cookies. Provided by: Unsplash. Located at: https://unsplash.com/photos/G4zLsxLIpAA. License: CC0: No Rights Reserved