The examples we have looked at were simplified in order to illustrate the process of job order costing. For a more complex order, you can probably imagine the amount of labor and direct materials it takes to make a custom yacht–like the ones manufactured by American Tugs in LaConner, Washington–and the amount of accounting it takes to accumulate those costs, including allocating overhead. However, the process is automated and the information is critical for the operation of the business, not only from a historical perspective but in forecasting and budgeting as well.

You can probably imagine the process. A client calls, or management, seeing idle capacity, decides to make a stock boat for sale later, and a production manager receives an order (either internal or external) for a new boat and starts a job card (or the accounting manager creates the job in the accounting system).

As soon as the mold is cleared, a crew pours fiberglass and creates the hull and the frame, requisitioning direct materials as needed from the stockroom and ordering parts, assigning each item to the correct job designation. At the end of each day, the work crew clocks out, making sure each block of time is correctly coded to whatever job was worked on. Supervisors code to a general overhead account that also accumulates rent on the manufacturing building, insurance, electricity, and all kinds of other general production costs allocated using either a plant-wide rate or a departmental or activity-based method.

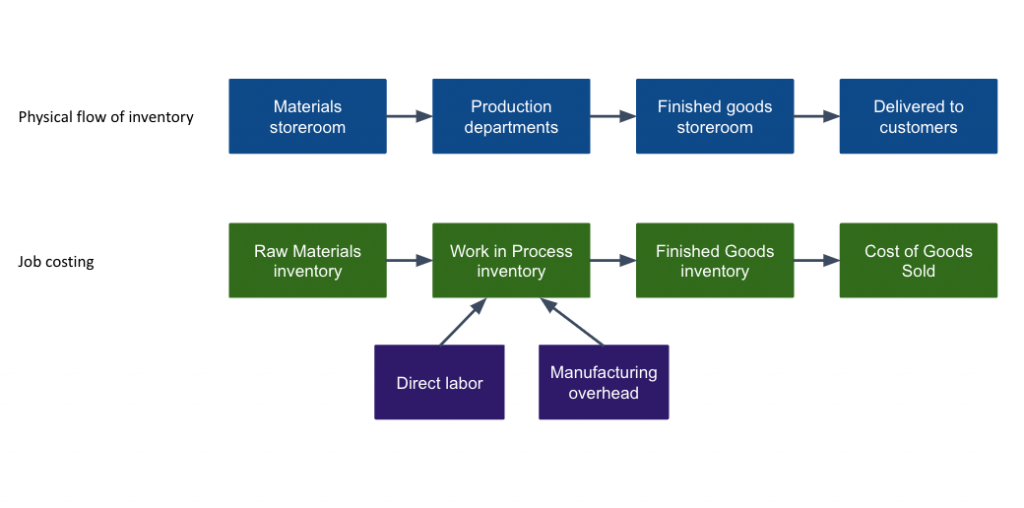

Costs accumulate in a work-in-process account by job until the boat is finished and launched, at which time an accountant moves the total costs of that job to a finished inventory account and, eventually, to cost of goods sold.

In addition, the company has accumulated costs that have to be paid, often in the form of accounts payable to be paid within 30 days. It may take months to complete a boat from a custom order, and the company is spending cash long before revenue comes in. Once the boat is delivered, the customer pays, and a new cycle starts.

At any point in time, there will be multiple boats in various stages of production, but always the job cards for boats not yet finished will be equal to work in process, and the job cards for boats finished but not yet delivered will be equal to finished goods inventory (title usually transfers upon delivery, at which time the sale is recognized). The job cards then, for boats finished and sold will equal cost of goods sold.

This is job costing in a nutshell, and so it works well for single, unique items or batches. For instance, a custom T-shirt company might use job costing. A print shop might use job costing. A construction company would most likely use job costing. But what about a winery, or a brewery? What about a company that buys tons of fruit and feeds that raw material into a machine that cooks it, strains it, adds gelatin, cools the finished product in giant vats, and then dispenses it into jars for sale as jam or jelly? Job costing is not appropriate for a continuous process like that. Instead, we use process costing, which has similarities, but clear differences.

Here is a review of the entire job costing method:

You can view the transcript for “Job Costing – Flow of Costs” here (opens in new window).

Candela Citations

- Why It Matters: Nature of Managerial Accounting. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Yacht on the sea. Authored by: David Maunsell. Provided by: Unsplash. Located at: https://unsplash.com/photos/D6fooIXYvRg. License: CC0: No Rights Reserved

- Job Costing - Flow of Costs. Authored by: Dr. Brian Routh. Located at: https://youtu.be/QBK8EraDkVs. License: All Rights Reserved. License Terms: Standard YouTube License

- Job Costing Inventory flowchart. Provided by: Lumen Learning. License: CC BY: Attribution