The term responsibility accounting refers to an accounting system that collects, summarizes, and reports accounting data relating to the responsibilities of individual managers.

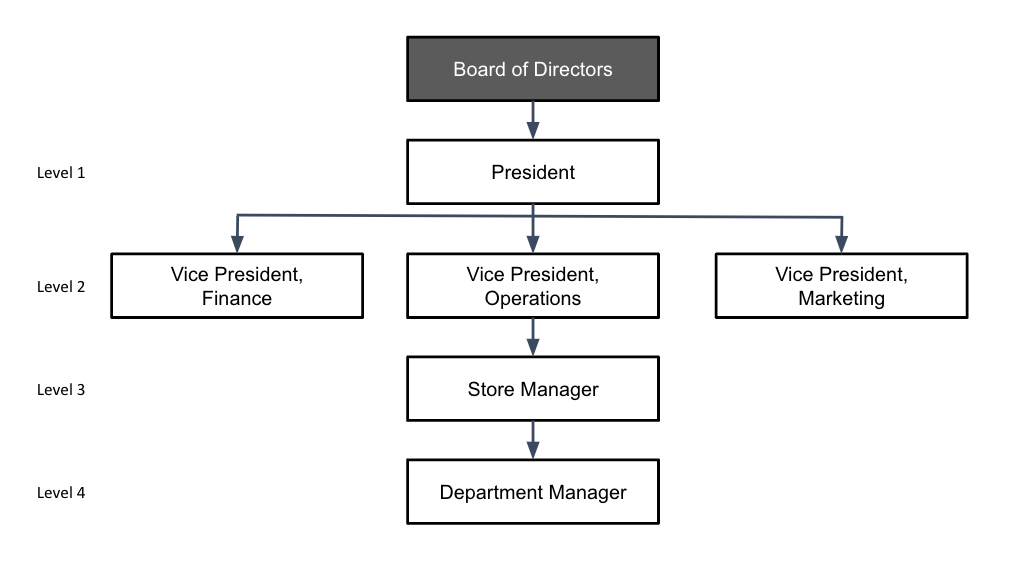

To implement responsibility accounting in a company, the business entity must be organized so that responsibility is assignable to individual managers. The various company managers and their lines of authority (and the resulting levels of responsibility) should be fully defined. The organization chart below demonstrates lines of authority and responsibility that could be used as a basis for responsibility reporting.

In the picture above we show that a department supervisor may report to a store manager, who reports to the vice president of operations, who reports to the president. The president is ultimately responsible to stockholders or their elected representatives, the board of directors. In a sense, the president is responsible for all revenue and expense items of the company, since at the presidential level all items are controllable over some period. The president often carries the title, Chief Executive Officer (CEO), and usually delegates authority to lower-level managers since one person cannot be fully informed of the day-to-day operating details of all areas of the business.

Most large businesses are decentralized, as we saw in the module on segments, and each segment has a hierarchy of some kind as well as performance measures. Sometimes these measures are informal, especially in a smaller business, and sometimes the measures are extremely well documented and tracked. Segments can be broken down into smaller units called responsibility centers, and all of these should be monitored and controlled in order to maximize profit and efficiency. Even in a non-profit organization, these segments and responsibility centers have to be monitored for effective performance (often, it is even more critical in a non-profit or government agency that has to report to donors, grantors, and the public).

Watch this short video to further explain the concept of responsibility accounting and to give you a preview of the rest of the module.

You can view the transcript for “Part 1 of Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard” here (opens in new window).

Candela Citations

- Why It Matters: Responsibility Accounting. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Part 1 of Responsibility Accounting, Operational Performance Measures, and the Balanced Scorecard. Authored by: Maxwell Katzman. Located at: https://youtu.be/EsS0socI3I4. License: All Rights Reserved. License Terms: Standard YouTube License