Organizing Journal Entries

We have covered a lot of new words and concepts in this chapter, this video gives you a preview of what happens next when we organize the journal entry information:

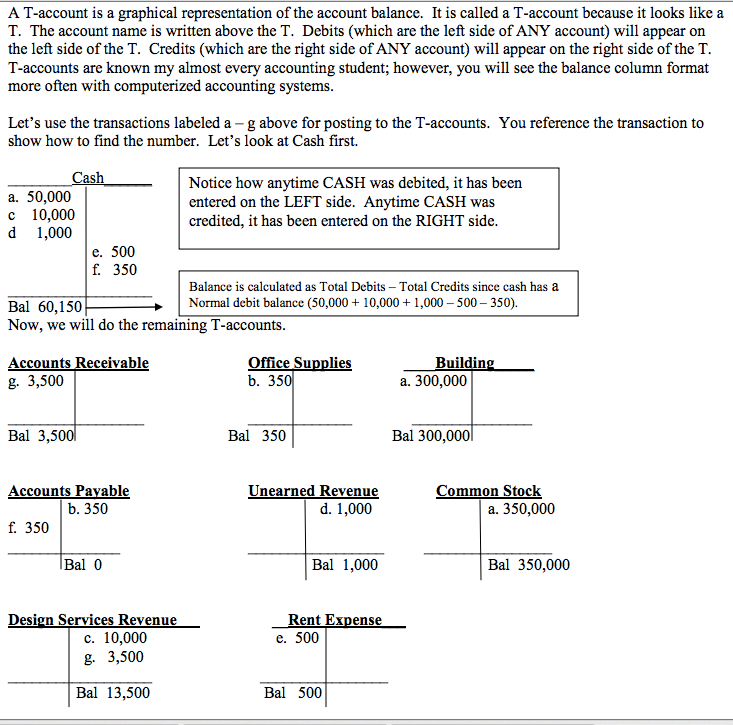

A journal entry is like a set of instructions. The carrying out of these instructions is known as posting. The video provides a clear description of where in the accounting cycle posting occurs. As stated earlier, posting is recording in the ledger accounts the information contained in the journal. The good news is you have already done the hard part — you have analyzed the transactions and created the journal entries. When you post, you will not change your journal entries. If you debit an account in a journal entry, you will debit the same account in posting. If you credit an account in a journal entry, you will credit the same account in posting. After transactions are journalized, they can be posted either to a T-account or a general ledger. Remember – a ledger is a listing of all transactions in a single account, allowing you to know the balance of each account. The ledger for an account is typically used in practice instead of a T-account but T-accounts are often used for demonstration because they are quicker and sometimes easier to understand. The general ledger is a compilation of the ledgers for each account for a business. Below is an example of what the T-Accounts would look like for a company.

In contrast to the two-sided T-account, the three-column ledger card format has columns for debit, credit, balance, and item description. The three-column form ledger card has the advantage of showing the balance of the account after each item has been posted. It is very important for you to understand the debit and credit rules for each account type or you may not calculate the balance correctly. Notice that we give an explanation for each item in the ledger accounts. Often accountants omit these explanations because each item can be traced back to the general journal for the explanation. The following are examples of Ledger cards for the some of the accounts from the same company shown in T-accounts above (see how you get the same balance under either approach).

Notice in these ledger examples that Cash is an asset and a debit increases an asset and a credit decreases an asset. Accounts Payable is a liability account and Design Services Revenue is a revenue account but both accounts increase with a credit and decrease with a debit.

Posting is always from the journal to the ledger accounts. Postings can be made (1) at the time the transaction is journalized; (2) at the end of the day, week, or month; or (3) as each journal page is filled. The choice is a matter of personal taste. When posting the general journal, the date used in the ledger accounts is the date the transaction was recorded in the journal, not the date the journal entry was posted to the ledger accounts.

The accounting equation serves as an error detection tool. If at any point the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts, an error has occurred. It follows that the sum of debits and the sum of the credits must be equal in value. Double-entry bookkeeping is not a guarantee that no errors have been made—for example, the wrong ledger account may have been debited or credited, or the entries completely reversed.

If you would like to see what it looks like to move journal postings into a general ledger in Excel, watch this additional video.