Learning Outcomes:

- Explain what economics and public economics is and why it is important

- Micro- vs Macro-Economics

- Two Roles Played by Economists

- Scientific Method

- Positive vs Normative Statements

- Explain How Economists Use Economic Models

- Circular Flow Diagram

- Market Structure

- Efficiency vs Equality

Public finance (also known as public economics) analyzes the impact of public policy on the allocation of resources and the distribution of income in the economy. The public sector accounts for about a third of all economic activity in the United States; and that ratio is small compared to some other industrialized countries. Government affects almost everything that we do in our daily lives, sometimes for the better, sometimes for the worse. In this course, you will learn how to use the tools of microeconomics and empirical analysis to study the taxing and the spending activities of the government. In this class topics such as social security, health insurance, income distribution and welfare programs, externalities and public goods, and taxation at federal, state, and local levels will be discussed.

What is Economics?

- How is economics different from finance or business administration or any other business school degree (marketing, management, etc.)?

- What is the difference between a physicists and an engineer?

- Economics is a social science!

- We study human behavior.

- Scarcity: the limited nature of society’s resources

- Economics: the study of how society manages its scarce resources, e.g.

- how people decide what to buy, how much to work, save, and spend

- how firms decide how much to produce, how many workers to hire

- how society decides how to divide its resources between national defense, consumer goods, protecting the environment, and other needs

- Economics is the study of the trade-offs and choices we make.

All decisions involve tradeoffs. Examples:

- Going to a party the night before your midterm leaves less time for studying.

- Having more money to buy stuff requires working longer hours, which leaves less time for leisure.

- Protecting the environment requires resources that could otherwise be used to produce consumer goods.

Micro vs Macro…what is Public economics?

- Microeconomics is the study of how households and firms make decisions and how they interact in markets.

- In micro we study individual markets (products), industries, sectors.

- Macroeconomics is the study of economy-wide phenomena, including inflation, unemployment, and economic growth.

- In macro we study economic events at the national (aggregate) level.

- These two branches of economics are closely intertwined, yet distinct—they address different questions.

- The goal of public economics or public finance is to understand the proper role of the government in the economy.

- It studied the public sector and as such is classified under Microeconomics. But this sector has an immense impact on the whole economy.

- In addition, we will use some of the fundamental concepts and economic indicators typically discuss in macroeconomics.

- On the expenditure side of public economics we ask: What kind of goods and services should the government provide, if any?

- On the revenue side of public economics we ask: How much should the government tax it’s citizens and how should that amount be related to the economic circumstances of those individuals?

The four fundamental questions of Public Economics:

1.When should the government intervene in the economy?

2.How might the government intervene?

3.What is the effect of those interventions on economics outcome?

4.Why do governments choose to intervene the way they do?

The fundamental lesson of basic economics is that, in most cases the competitive market equilibrium is the most efficient outcome for society.

If the competitive equilibrium does not lead to the efficiency-maximizing outcome, there is the potential for efficiency improvement through government intervention.

- Market Failure: problems that cause a market economy to deliver an outcome that does not maximize efficiency.

- Examples of Market Failure:

- Externalities (positive and negative)

- Public Goods

- Monopoly or better yet….non-competitive markets

- Missing Markets

- Incomplete Markets

- Information Failure

- Principal-Agent Problems

- Redistribution: the shifting of resources from some groups in society to others.

- As scientists, economists make

positive statements,

which attempt to describe the world as it is. - As policy advisors, economists make

normative statements,

which attempt to prescribe how the world should be. - Positive statements can be confirmed or refuted,

normative statements cannot.

What is Public Economics?

Public economics (or economics of the public sector) is the study of government policy through the lens of economic efficiency and equity. Public economics builds on the theory of welfare economics and is ultimately used as a tool to improve social welfare.

Public economics provides a framework for thinking about whether or not the government should participate in economic markets and to what extent it should do so. Microeconomic theory is utilized to assess whether the private market is likely to provide efficient outcomes in the absence of governmental interference; this study involves the analysis of government taxation and expenditures.

This subject encompasses a host of topics notably market failures such as, public goods, externalities and Imperfect Competition, and the creation and implementation of government policy.

Broad methods and topics include:

- the theory and application of public finance

- analysis and design of public policy

- distributional effects of taxation and government expenditures

- analysis of market failure[5] and government failure.

Emphasis is on analytical and scientific methods and normative-ethical analysis, as distinguished from ideology. Examples of topics covered are tax incidence, optimal taxation, and the theory of public goods.

Market Failures

The role of government in providing efficient and equitable markets is largely underpinned by addressing market failures that may arise. Public Economics focuses on when and to what degree the government should intervene in the economy to address market failures. Some examples of government intervention are providing pure public goods such as defense, regulating negative externalities such as pollution and addressing imperfect market conditions such as asymmetric information.

Public Goods

Pure public goods, or collective consumption goods, exhibit two properties; non-rivalry and non-excludability. Something is non-rivaled if one person’s consumption of it does not deprive another person, (to a point) a firework display is non-rivaled – since one person watching a firework display does not prevent another person from doing so. Something is non-excludable if its use cannot be limited to a certain group of people. Again, since one cannot prevent people from viewing a firework display it is non-excludable. Another example, of a pure public good is knowledge. Consider a book. The book itself can be destroyed and thus is excludable. However, the knowledge obtained from the book is far more difficult to destroy and is non-rivalrous and non-excludable. In reality, not all public goods can be classed as ‘pure’ and most display some degree of excludability and rivalrous. These are known as Impure public goods.

Due to the two unique properties that public goods exhibit, being non-rivalrous & non-excludable, it is unlikely that without intervention markets will produce the efficient amount. It therefore, the role of government to regulate the production of public goods so as to create an efficient market equilibrium.[19]

Externalities

Externalities arise when consumption by individuals or production by firms affect the utility or production function of other individuals or firms. Positive externalities are education, public health and others while examples of negative externalities are air pollution, noise pollution, non-vaccination and more.

Pigou describes as positive externalities, examples such as resources invested in private parks that improve the surrounding air, and scientific research from which discoveries of high practical utility often grow. Alternatively, he describes negative externalities, such as the factory that destroys a great part of the amenities of neighboring sites.

The role of government is to address the negative external effects and societal deadweight loss created from inefficient markets

Imperfect Competition

Imperfect competition within markets can take many forms and will often depend on the barriers to entry, firms profit and production objectives and the nature of the product and respective market. Imperfect competition will lead to a social cost and it is the role of government to minimize this cost. Some notable imperfection include:

- Companies sell differentiated products

- There are barriers to exit and entry

- Suboptimal output and pricing

In its essence, the role of government is to address the issues that arise from these market failures and decide the optimal degree of intervention necessary.

Basics of the Government Institutions and Types of Economic Policies

Here are three very important questions that everyone should understand:

- What is the difference between The Federal Government and The Federal Reserves?

- What is the difference between Treasury Department and The Federal Reserves?

- What is the difference between Fiscal and Monetary Policy?

First a very short explanation: The Treasury makes payments as ordered by the Executive branch agencies based on budgets set by Legislature. The Fed processes payments as a kind of middleman between Government and private banks. The Fed controls monetary policy — interest rate targets in financial markets. Fed sets the overnight funds rate. Treasury is an agent of fiscal policy — spending — but spends what it is ordered to spend by other agencies and Congress

There’s more to the story. Let’s get into this topic a bit more carefully!

One of the biggest points in confusion in economics (especially macroeconomics and public policy) is the difference first between the Federal Government and the Federal Reserve also referred to as The Fed. The main reason for the confusion may come from the fact that both of these two institutions have the term “federal” in it. But these institutions are quite different from each other and play very different roles in the US economy.

Let’s first start with the US Federal Government.

The United States of America has a very complex government system. First, it is comprised of 50 states with it’s own state, municipal and local governments. The union of these 50 states is tied together be the Federal Government. The federal government of the United States (U.S. federal government) is the national government of the United States, composed of 50 states. The United States government is based on the principles of federalism and republicanism, in which power is shared between the federal government and state governments. Federalism in the United States is the constitutional division of power between U.S. state governments and the federal government of the United States. The argument of which should hold more power has dominated the federalism debate, with the Republican Party traditionally favoring strong state governments and weak federal government and the Democratic Party, the opposite.

The federal government is composed of three distinct branches: legislative (the Congress), executive (the president), and judicial (he federal courts) whose powers are vested by the U.S. Constitution.

State governments have the greatest influence over most Americans’ daily lives. The Tenth Amendment prohibits the federal government from exercising any power not delegated to it by the Constitution; as a result, states handle the majority of issues most relevant to individuals within their jurisdiction. Because state governments are not authorized to print currency, they generally have to raise revenue through either taxes or bonds. As a result, state governments tend to impose severe budget cuts or raise taxes any time the economy is faltering.

The Department of the Treasury (USDT) is the national treasury of the federal government of the United States where it serves as an executive department. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy.

The Federal Reserve or the Fed is America’s central bank. Its job is to manage the U.S. money supply. For that reason, many people say the Fed prints money. That doesn’t mean the Fed has a printing press that cranks out dollars. Only the U.S. Department of the Treasury does that. In other words, the U.S. Treasury Department prints the money, but it’s the Federal Reserve Banks that controls and distribute it.

Each of the 12 Federal Reserve Banks keeps an inventory of cash on hand to meet the needs of the depository institutions in its District. The Treasury Department has two divisions that produce the cash: the Bureau of Engraving and Printing, which prints currency, and the United States Mint, which makes coins. So, yes, technically and logistically speaking it is the Treasury Department that physically creates (prints and mints) the money, but it’s up to the Fed to decide how much of it they want to distribute it. In addition, the Fed can increase or decrease the money supply without actually printing any money. This is part of their monetary policy. As a result, most economists refer to the Fed as “printing” or creating the money not to the Treasury.

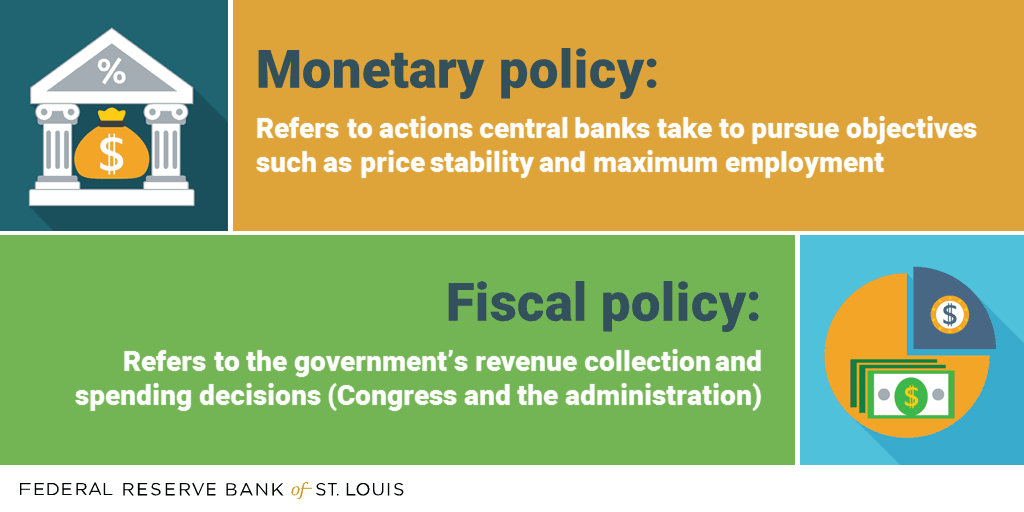

What is the difference between Fiscal and Monetary Policy?

In Short: Monetary policy refers to the actions of central banks to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth. Fiscal policy refers to the tax and spending policies of the federal government. Fiscal policy decisions are determined by the Congress and the Administration; the Fed plays no role in determining fiscal policy.

Learning the difference between fiscal policy and monetary policy is essential to understanding who does what when it comes to the federal government and the Federal Reserve. The short answer is that Congress and the administration conduct fiscal policy, while the Fed conducts monetary policy.

Both types of policy can have a significant effect on our everyday lives, but the lines between them can seem blurry to the average consumer. Let’s sort it out.

Monetary Policy Is the Federal Reserve’s Role

The word “monetary” means having to do with money. And monetary policy is the wheelhouse of a central bank. How does the Federal Reserve conduct monetary policy? It can do so by influencing the supply of money in the economy, as well as influencing interest rates in markets.

To influence the money supply and interest rates, the Fed has various tools. Some key ones include:

- Open market operations

- The discount rate

- Reserve requirements

- Interest on reserve balances

Fiscal Policy Is the Federal Government’s Role

The word “fiscal” relates to public treasury or revenues. Fiscal policy is a broad term used to refer to the tax and spending policies of the federal government. Fiscal policy refers to government spending and taxing decisions. Economics textbooks and various economic models usually think of fiscal policy in terms of the size of the government budget deficit, the difference between what the government spends and its revenue.

In short, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country’s economy. Fiscal policy is when governments at all levels (federal, state, or local) are adjusting their taxes, subsidies, or expenditures. But when it comes to the mainstream political debates, we are typically focusing on the federal government. These are precisely the issues that are covered in public finance and public economics.

On the other had, monetary policy conducted via the Fed by fixing the money supply is a macroeconomic topic typically addresses in a class on Money and Banking and Financial Economics. This will NOT be the focus of this class!

Efficiency vs Equity

Few questions to consider:

What is the role of the government in the economy?