Learning Objectives

- Trace the budget process.

- Discuss the relationships of goals and behaviors.

- Demonstrate the importance of conservatism in the budget process.

- Show the importance of timing in the budget process.

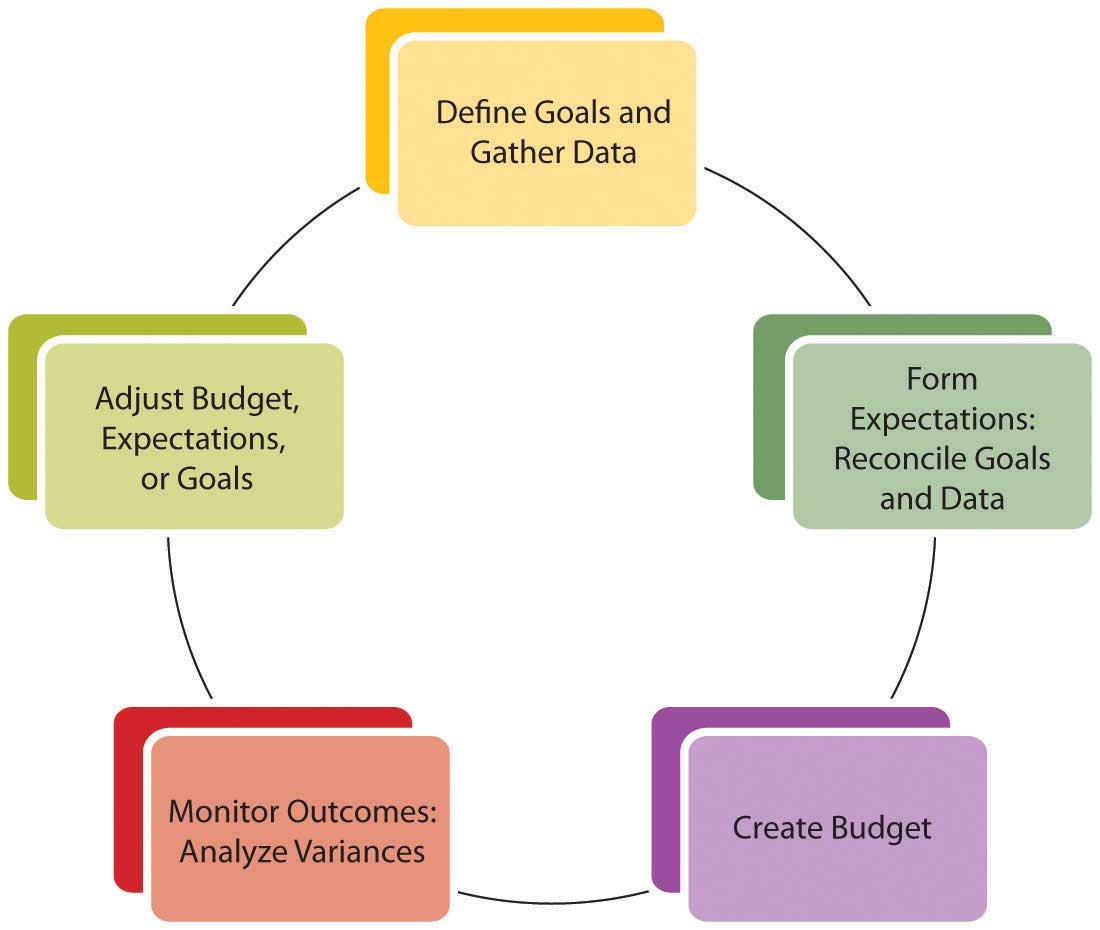

The budget process is an infinite loop similar to the larger financial planning process. It involves

- defining goals and gathering data;

- forming expectations and reconciling goals and data;

- creating the budget;

- monitoring actual outcomes and analyzing variances;

- adjusting budget, expectations, or goals;

- redefining goals.

Figure 5.2 The Budget Process

A review of your financial statements or your current financial condition—as well as your own ideas about how you are and could be living—should indicate immediate and longer-term goals. It may also point out new choices. For example, an immediate goal may be to lower housing expense. In the short-term you could look for an apartment with lower rent, but in the long run, it may be more advantageous to own a home. This long-term goal may indicate a need to start a savings plan for a down payment.

The process of creating a budget can be instructive. Creating a budget involves projecting realistic behavior. Your assumptions may come from your actual past behavior based on accurate records that you have gathered. If you have been using personal finance software, it has been keeping those records for you; if not, a thorough review of your checkbook and investment statements will reveal that information. Financial statements are useful summaries of the information you need to create a budget.

After formulating realistic expectations based on past behavior and current circumstances, you still must reconcile your future behavior with your original expectations. For example, you may recognize that greater sacrifices need to be made, or that you must change your behavior, or even that your goals are unattainable and should be more realistic—perhaps based on less desirable choices. On the other hand, this can be a process of happy discovery: goals may be closer or require less sacrifice than you may have thought.

Whether it results in sobering dismay or ambitious joy, the budget process is one of reconciling your financial realities to your financial dreams. How you finance your life determines how you can live your life, so budgeting is really a process of mapping out a life strategy. You may find it difficult to separate the emotional and financial aspects of your goals, but the more successfully you can do so, the more successfully you will reach your goals.

A budget is a projection of how things should work out, but there is always some uncertainty. If the actual results are better than expected, if incomes are more or expenses less, expectations can be adjusted upward as a welcome accommodation to good fortune. On the other hand, if actual results are worse than expected, if incomes are less or expenses more, not only the next budget but also current living choices may have to be adjusted to accommodate that situation. Those new choices are less than preferred or you would have chosen them in your original plan.

To avoid unwelcome adjustments, you should be conservative[1] in your expectations so as to maximize the probability that your actual results will be better than expected. Thus, when estimating, you would always underestimate the income items and potential gains and overestimate the expense items and potential losses.

You will also need to determine a time period and frequency for your budget process: annually, monthly, or weekly. The timing will depend on how much financial activity you have and how much discipline or guidance you want your budget to provide. You should assess your progress at least annually. In general, you want to keep a manageable amount of data for any one period, so the more financial activity you have, the shorter your budget period should be. Since your budget needs to be monitored consistently, you don’t want to be flooded with so much data that monitoring becomes too daunting a task. On the other hand, you want to choose an ample period or time frame to show meaningful results. Choose a time period that makes sense for your quantity of data or level of financial activity.

Key Takeaways

- A budget is a process that mirrors the financial planning process.

- The process of creating a budget can suggest goals, behaviors, and limitations.

- For the budget to succeed, goals and behaviors must be reconciled.

-

Budgets should be prepared conservatively:

- Overestimate costs.

- Underestimate earnings.

-

The appropriate time period is one that is

- short enough to limit the amount of data,

- long enough to capture meaningful data.

Exercises

- In My Notes or your financial planning journal, begin your budgeting process by reviewing your short-term and long-term goals. What will it take to achieve those goals? What limitations and opportunities do you have for meeting them? Then gather your financial data and choose a time period and frequency for checking your progress.

- View the video “Making a Budget—1” from Expert Village at http://www.youtube.com/watch?v=rd_gGHKz0F0. According to this video, why is a budget so important in personal financial planning? What kinds of problems can you resolve by manipulating your personal budget? What kinds of goals can you attain through changes to your personal budget?

Candela Citations

- Personal Finance. Provided by: Saylor Academy. Located at: https://saylordotorg.github.io/text_personal-finance. License: CC BY-NC-SA: Attribution-NonCommercial-ShareAlike

- In finance, an approach preferred in all financial planning: overestimate expenses, losses, and the value of liabilities and underestimate incomes, gains, and the value of assets. This is based on the idea that any surprises should be advantageous. The use of this word in finance and accounting has absolutely no relation to any political associations that the word may have gained in common usage. ↵