Learning Outcomes

- Calculate compound interest given an interest scenario

- Calculate the initial balance given an interest scenario

Compounding

With simple interest, we were assuming that we pocketed the interest when we received it. In a standard bank account, any interest we earn is automatically added to our balance, and we earn interest on that interest in future years. This reinvestment of interest is called compounding.

Suppose that we deposit $1000 in a bank account offering 3% interest, compounded monthly. How will our money grow?

The 3% interest is an annual percentage rate (APR) – the total interest to be paid during the year. Since interest is being paid monthly, each month, we will earn [latex]\frac{3%}{12}[/latex]= 0.25% per month.

In the first month,

- P0 = $1000

- r = 0.0025 (0.25%)

- I = $1000 (0.0025) = $2.50

- A = $1000 + $2.50 = $1002.50

In the first month, we will earn $2.50 in interest, raising our account balance to $1002.50.

In the second month,

- P0 = $1002.50

- I = $1002.50 (0.0025) = $2.51 (rounded)

- A = $1002.50 + $2.51 = $1005.01

Notice that in the second month we earned more interest than we did in the first month. This is because we earned interest not only on the original $1000 we deposited, but we also earned interest on the $2.50 of interest we earned the first month. This is the key advantage that compounding interest gives us.

Calculating out a few more months gives the following:

| Month | Starting balance | Interest earned | Ending Balance |

| 1 | 1000.00 | 2.50 | 1002.50 |

| 2 | 1002.50 | 2.51 | 1005.01 |

| 3 | 1005.01 | 2.51 | 1007.52 |

| 4 | 1007.52 | 2.52 | 1010.04 |

| 5 | 1010.04 | 2.53 | 1012.57 |

| 6 | 1012.57 | 2.53 | 1015.10 |

| 7 | 1015.10 | 2.54 | 1017.64 |

| 8 | 1017.64 | 2.54 | 1020.18 |

| 9 | 1020.18 | 2.55 | 1022.73 |

| 10 | 1022.73 | 2.56 | 1025.29 |

| 11 | 1025.29 | 2.56 | 1027.85 |

| 12 | 1027.85 | 2.57 | 1030.42 |

We want to simplify the process for calculating compounding, because creating a table like the one above is time consuming. Luckily, there is a formula for compound interest (found below) that we can use!

Compound Interest

[latex]P_{N}=P_{0}\left(1+\frac{r}{k}\right)^{Nk}[/latex]

- PN is the balance in the account after N years.

- P0 is the starting balance of the account (also called initial deposit, or principal)

- r is the annual interest rate in decimal form

- N is the number of years

- k is the number of compounding periods in one year

- If the compounding is done annually (once a year), k = 1.

- If the compounding is done quarterly, k = 4.

- If the compounding is done monthly, k = 12.

- If the compounding is done daily, k = 365.

In the next example, we show how to use the compound interest formula to find the balance on a certificate of deposit after 20 years.

don’t forget to convert percent to a decimal

Usually, in order to perform calculations on a number expressed in percent form, you’ll need to convert it to decimal form. The rate [latex]r[/latex] in interest formulas must be converted from percent to decimal form before you use the formula.

Example

A certificate of deposit (CD) is a savings instrument that many banks offer. It usually gives a higher interest rate, but you cannot access your investment for a specified length of time. Suppose you deposit $3000 in a CD paying 6% interest, compounded monthly. How much will you have in the account after 20 years?

A video walkthrough of this example problem is available below.

Let us compare the amount of money earned from compounding against the amount you would earn from simple interest. Suppose that we deposit $3000 into two accounts (one earning 6% simple interest annually and the other earning 6% compounded monthly). Notice in both the table and the graph how the account earning compound interest grows much more rapidly than the one earning simple interest.

| Years | Simple Interest ($15 per month) | 6% compounded monthly = 0.5% each month. |

| 0 | $3000 | $3000 |

| 5 | $3900 | $4046.55 |

| 10 | $4800 | $5458.19 |

| 15 | $5700 | $7362.28 |

| 20 | $6600 | $9930.61 |

| 25 | $7500 | $13394.91 |

| 30 | $8400 | $18067.73 |

| 35 | $9300 | $24370.65 |

As you can see, over a long period of time, compounding makes a large difference in the account balance.

Try It

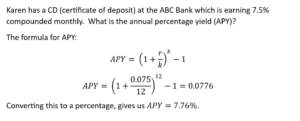

APY – Annual Percentage Yield

- APY is the actual rate of return that will be earned in one year if the interest is compounded.

- Compound interest is added periodically to the total invested, increasing the balance. That means each interest payment will be larger, based on the higher balance.

- The more often interest is compounded, the higher the APY will be.

- APY has a similar concept as annual percentage rate (APR), but APR is used for loans.

To calculate the Annual Percentage Yield (APY), here is the formula:

[latex]APY=\left(1+\frac{r}{k}\right)^{k} - 1[/latex]

This will give you APY as a decimal. You will then need to multiply by 100 (or move the decimal point two places to the right) to convert the APY to a percentage.

Example

Evaluating exponents on the calculator

When we need to calculate something like [latex]5^3[/latex] it is easy enough to just multiply [latex]5\cdot{5}\cdot{5}=125[/latex]. But when we need to calculate something like [latex]1.005^{240}[/latex], it would be very tedious to calculate this by multiplying [latex]1.005[/latex] by itself [latex]240[/latex] times! So to make things easier, we can harness the power of our scientific calculators.

Most scientific calculators have a button for exponents. It is typically either labeled like:

^ , [latex]y^x[/latex] , or [latex]x^y[/latex] .

To evaluate [latex]1.005^{240}[/latex] we’d type [latex]1.005[/latex] ^ [latex]240[/latex], or [latex]1.005 \space{y^{x}}\space 240[/latex]. Try it out – you should get something around 3.3102044758.

Example

You know that you will need $40,000 for your child’s education in 18 years. If your account earns 4% compounded quarterly, how much would you need to deposit now to reach your goal?

Try It

Rounding

It is important to be very careful about rounding when calculating things with exponents. In general, you want to keep as many decimals during calculations as you can. Be sure to keep at least 3 significant digits (numbers after any leading zeros). Rounding 0.00012345 to 0.000123 will usually give you a “close enough” answer, but keeping more digits is always better.

Example

To see why not over-rounding is so important, suppose you were investing $1000 at 5% interest compounded monthly for 30 years.

| P0 = $1000 | the initial deposit |

| r = 0.05 | 5% |

| k = 12 | 12 months in 1 year |

| N = 30 | since we’re looking for the amount after 30 years |

If we first compute r/k, we find 0.05/12 = 0.00416666666667

Here is the effect of rounding this to different values:

| r/k rounded to: | Gives P30 to be: | Error |

| 0.004 | $4208.59 | $259.15 |

| 0.0042 | $4521.45 | $53.71 |

| 0.00417 | $4473.09 | $5.35 |

| 0.004167 | $4468.28 | $0.54 |

| 0.0041667 | $4467.80 | $0.06 |

| no rounding | $4467.74 |

If you’re working in a bank, of course you wouldn’t round at all. For our purposes, the answer we got by rounding to 0.00417, three significant digits, is close enough – $5 off of $4500 isn’t too bad. Certainly keeping that fourth decimal place wouldn’t have hurt.

View the following for a demonstration of this example.

Using your calculator

In many cases, you can avoid rounding completely by how you enter things in your calculator. For example, in the example above, we needed to calculate [latex]{{P}_{30}}=1000{{\left(1+\frac{0.05}{12}\right)}^{12\times30}}[/latex]

We can quickly calculate 12×30 = 360, giving [latex]{{P}_{30}}=1000{{\left(1+\frac{0.05}{12}\right)}^{360}}[/latex].

Now we can use the calculator.

| Type this | Calculator shows |

| 0.05 ÷ 12 = . | 0.00416666666667 |

| + 1 = . | 1.00416666666667 |

| yx 360 = . | 4.46774431400613 |

| × 1000 = . | 4467.74431400613 |

Using your calculator continued

The previous steps were assuming you have a “one operation at a time” calculator; a more advanced calculator will often allow you to type in the entire expression to be evaluated. If you have a calculator like this, you will probably just need to enter:

1000 × ( 1 + 0.05 ÷ 12 ) yx 360 =

Candela Citations

- Question ID 6692. Authored by: Lippman,David. License: CC BY: Attribution. License Terms: IMathAS Community License CC-BY + GPL

- Revision and Adaptation. Provided by: Lumen Learning. License: CC BY: Attribution

- Math in Society. Authored by: Open Textbook Store, Transition Math Project, and the Open Course Library. Located at: http://www.opentextbookstore.com/mathinsociety/. License: CC BY-SA: Attribution-ShareAlike

- achievement-bar-business-chart-18134. Authored by: PublicDomainPictures. Located at: https://pixabay.com/en/achievement-bar-business-chart-18134/. License: CC0: No Rights Reserved

- Compound Interest. Authored by: OCLPhase2's channel. Located at: https://youtu.be/xuQTFmP9nNg. License: CC BY: Attribution

- Compound interest CD example. Authored by: OCLPhase2's channel. Located at: https://youtu.be/8NazxAjhpJw. License: CC BY: Attribution

- Compound interest - the importance of rounding. Authored by: OCLPhase2's channel. Located at: https://youtu.be/VhhYtaMN6mo. License: CC BY: Attribution

- Question ID 6693. Authored by: Lippman,David. License: CC BY: Attribution. License Terms: IMathAS Community License CC-BY + GPL