Learning Outcomes

- Calculate sales and income taxes

Governments collect taxes to pay for the services they provide. In the United States, federal income taxes help fund the military, the environmental protection agency, and thousands of other programs. Property taxes help fund schools. Gasoline taxes help pay for road improvements. While very few people enjoy paying taxes, they are necessary to pay for the services we all depend upon.

Taxes can be computed in a variety of ways, but are typically computed as a percentage of a sale, of one’s income, or of one’s assets.

recall calculations with percents

To make calculations using percents, first convert the percent to a decimal by dropping the % symbol and moving the decimal two places to the left (adding more zeros to the left as needed). When you move the decimal two places to the left, this is the same as dividing by 100. Recall the “percent” means “per 100” and the word “per” in math is often used to refer to division.

Ex. Write 2.7% as a decimal

Write 2.7 then move the decimal two places left to divide by 100 (adding more zeros to the left as needed).

0.027 is the decimal representation of 2.7%.

Example: Sales Tax

The sales tax rate in a city is 9.3%. How much sales tax will you pay on a $140 purchase?

When taxes are not given as a fixed percentage rate, sometimes it is necessary to calculate the effective tax rate: the equivalent percent rate of the tax paid out of the dollar amount the tax is based on.

Write a ratio as a percent

To obtain a percent from a ratio, divide the part by the whole and multiply by 100.

Ex. If 87 out of 932 people polled claim to dislike pizza, the percent of people polled who stated they don’t like pizza is:

[latex]\dfrac{\text{ part }}{\text{ whole }}=\dfrac{87}{932} \approx .0934[/latex]

[latex].0934 \cdot 100 = 9.34 \%[/latex].

Example: Property Tax

Jaquim paid $3,200 in property taxes on his house valued at $215,000 last year. What is the effective tax rate?

Here is another example:

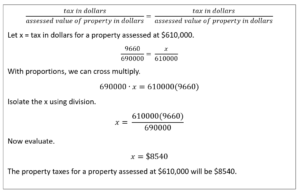

In Washington DC, the tax on a property assessed at $690,000 is $9,660. If tax rates are proportional in this city, how much would the tax be on a property assessed at $610,000?

We can use proportions to solve this problem.

Taxes are often referred to as progressive, regressive, or flat.

- A flat tax, or proportional tax, charges a constant percentage rate.

- A progressive tax increases the percent rate as the base amount increases.

- A regressive tax decreases the percent rate as the base amount increases.

Example: Federal Income Tax

Income Tax

The United States federal government collects income tax and most (but not all) states collect a state income tax. The United States federal income tax on earned wages is an example of a progressive tax. People with a higher wage income pay a higher percent tax on their income.

Income tax is based on gross income which is your total earned income for the year (this includes not just your wages but also interest earnings and even lottery winnings). However gross income is not directly used to calculate the amount of income tax that you owe for the year. You are allowed to adjust your gross income by subtracting deposits made to a retirement account (along with other things). After making these adjustments, you have an adjusted gross income. Wait! You are allowed deductions (and in some years we were also allowed personal exemptions). Taxable income is what is used in the calculations for your income taxes.

Adjusted Gross Income = Gross Income – Adjustments

Taxable Income = Adjusted Gross Income – Deductions – Any Allowed Exemptions

Below are a couple of basic examples to show calculations of income taxes based on the taxable income and the federal tax table for the year 2011. These tax tables are updated each year so it is important to make sure that you are using the correct table.

Examples:

For a single person in 2011, taxable income (subtract deductions and any personal exemptions from adjusted gross income) up to $8,500 was taxed at 10%. Income over $8,500 but up to $34,500 was taxed at 15%.

Taxable Income of $10,000

Stephen’s taxable income was $10,000 in 2011. He would pay 10% on the portion of his income up to $8,500, and 15% on the income over $8,500.

8500(0.10) = 850 10% of $8500

1500(0.15) = 225 15% of the remaining $1500 of income

Total tax: = $1075

What was Stephen’s effective tax rate?

Taxable Income of $30,000

D’Andrea’s taxable income was $30,000 in 2011. She would also pay 10% on the portion of her income up to $8,500, and 15% on the income over $8,500.

8500(0.10) = 850 10% of $8500

21500(0.15) = 3225 15% of the remaining $21500 of income

Total tax: = $4075

What was D’Andrea’s effective tax rate?

Notice that the effective rate has increased with income, showing this is a progressive tax.

Example: Gasoline Tax

A gasoline tax is a flat tax when considered in terms of consumption. A tax of, say, $0.30 per gallon is proportional to the amount of gasoline purchased. Someone buying 10 gallons of gas at $4 a gallon would pay $3 in tax, which is $3/$40 = 7.5%. Someone buying 30 gallons of gas at $4 a gallon would pay $9 in tax, which is $9/$120 = 7.5%, the same effective rate.

However, in terms of income, a gasoline tax is often considered a regressive tax. It is likely that someone earning $30,000 a year and someone earning $60,000 a year will drive about the same amount. If both pay $60 in gasoline taxes over a year, the person earning $30,000 has paid 0.2% of their income, while the person earning $60,000 has paid 0.1% of their income in gas taxes.

Try It

A sales tax is a fixed percentage tax on a person’s purchases. Is this a flat, progressive, or regressive tax?

Candela Citations

- Revision and Adaptation. Provided by: Lumen Learning. License: CC BY: Attribution

- Problem Solving. Authored by: David Lippman. Located at: http://www.opentextbookstore.com/mathinsociety/. License: CC BY-SA: Attribution-ShareAlike

- Authored by: Calita Kabir. Located at: https://flic.kr/p/8NsU6C. License: CC BY: Attribution

- Question ID 65951. Authored by: Parker,Gary. License: CC BY: Attribution. License Terms: IMathAS Community License CC-BY + GPL

- Question ID 80109. Authored by: Lumen Learning. License: CC BY: Attribution. License Terms: IMathAS Community License CC-BY + GPL