Learning Outcomes

- Describe situations in which activity-based absorption costing is used

The simplest method for estimating factory overhead is to use the same predetermined rate in all departments, for all activities and for all products in a manufacturing facility. Two amounts must be estimated for the calculation, as follows:

Total budgeted factory overhead

Total budgeted activity base (such as direct labor hours, machine hours, etc.)

The single factory overhead rate is a very loose estimate because it relies on one fixed dollar amount to assign factory overhead costs across the many facets, various segments, and different activities involved in the manufacturing process. It is unlikely that one rate can capture all the diversity of what goes on in a factory with reliable precision.

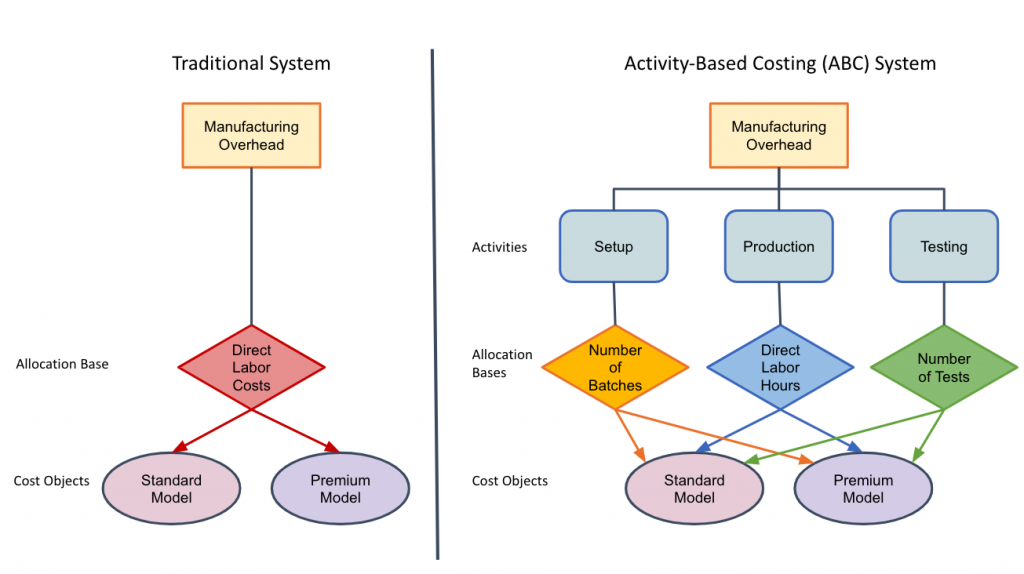

Departmental rates are more precise than a single, organization-wide rate, but another option is Activity-Based Costing (ABC).

Activity-based costing (ABC) is a more specific and more accurate way of assigning factory overhead to manufactured goods versus using a single factory or multiple departmental rates. An activity is a unit of work that consumes resources when performed by a company. A cost object (in the case of manufacturing, the item produced) is the target of the activity. Common examples of cost objects include products, jobs, services, projects, clients, patients, customers, and contracts.

In this method, we look only at non-direct costs. Direct costs are easily traced to an activity, so we don’t need to do anything further with those costs. Non-direct costs are the overhead costs, such as rent, property taxes, accounting and administrative costs and all other costs not directly related to the production of our product.

Activity-based absorption costing (ABC) is much more complicated that traditional costing, but can give you a much better allocation picture. Let’s look at an example where ABC may produce a better picture for a company.

Example

You are a manager at a company that makes two kinds of kayaks: the basic model and the deluxe. Currently, you are using a traditional costing method and assigning manufacturing overhead based on direct labor hours. So all of the direct labor and materials are being charged to each of the models, and then the overhead is allocated. But what if the deluxe kayak is consuming three times as much machine time due to more frequent setups? Or what if there are more parts in the deluxe model requiring a great deal more time in the purchasing department? These activities could cause traditional costing to be “off” compared to costing based on each activity.

This is a situation, where ABC may be more reflective of the actual cost allocation. It is necessary to determine if the benefits of implementing the ABC method outweigh the costs. After doing an evaluation of your situation, then the decision can be made regarding which method to utilize.

Practice Questions

Candela Citations

- Activity-Based Costing. Authored by: Freedom Learning Group. Provided by: Lumen Learning. License: CC BY: Attribution

- Traditional System vs. ABC Costing System. Provided by: Lumen Learning. License: CC BY: Attribution