Learning Outcomes

- Analyze the variance between expected variable manufacturing overhead cost and actual variable manufacturing overhead costs

As a manager in the accounting department, you have been tasked with determining the overhead rate for your manufacturing department. This information is important, as when you price your product or bid jobs, if you don’t include the cost of things like electricity and rent and depreciation on your equipment, you will be underpricing your stuff! Let’s take a look at an explanation of the why and how to calculate the variable manufacturing rate and understand why it is so important! Then we will talk about when this number varies from what we had originally calculated.

So we are again looking at two components: The manufacturing overhead rate variance and the manufacturing overhead efficiency variance. The rate variance happens when there is a change in the components of the variable hourly rate.

A rate variance may occur if the cost of one of the components of this rate goes up. An example might be the cost of the needles for the machines that sew together the shoes, or a steep hike in the electricity rate.

A difference in the efficiency rate occurs when it takes more hours than budgeted to manufacture the budgeted number of pair of shoes.

We figured out our expected variable manufacturing overhead for Hupana Running Company back when we were working on our master budget. Here is a reminder for you!

Since we already figured out our variable rate in a previous unit (remember, it was way back when we were working on our master budget), we can use this number in our calculations.

So Mary, our production manager, has noticed an increase in the cost of some of the supplies that go into the manufacturing of our shoes. Apparently, there is a thread shortage, and our supplier has raised the price. That, along with more needles breaking in the machines, has raised our variable overhead cost from $3 per hour to $3.25 per hour. Let’s take a look at how that may affect our variable overhead cost for Hupana:

Here is our budget:

| Total | |

|---|---|

| Budgeted direct labor hours | 1025 |

| Variable manufacturing overhead rate | $3 |

| Variable manufacturing overhead | $3,075 |

And here is what actually happened:

| Total | |

|---|---|

| Budgeted direct labor hours | 1025 |

| Variable manufacturing overhead rate | $3.25 |

| Variable manufacturing overhead | $3,331.25 |

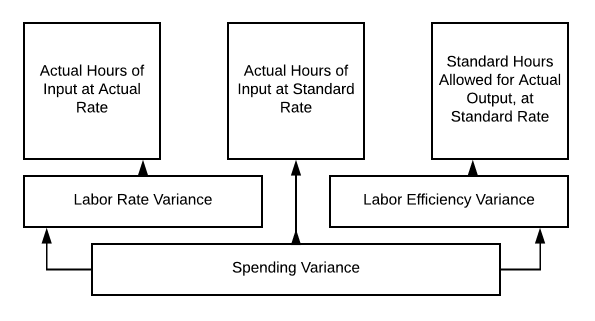

So you can see, this change has caused an increase in our variable manufacturing overhead. This is a rate change, so let’s analyze it using what we know. (You can refer back to the diagram on 10.4 if needed)

- Actual Quantity of Input at Actual Cost = 1025 × $3.25 = $3331.25

- Actual Quantity of Input at Standard Cost= 1025 × $3.00 = $3075.00

- Price Variance = $3331.25 − $3075.= $256.25 unfavorable variance. We spent more than anticipated.

So, if the direct labor hours remain the same, our spending variance will be $256.25—unfavorable. So, a reduction in the variable manufacturing overhead rate would create a favorable price variance.

So, a rise in the variable manufacturing overhead rate will cause an unfavorable variance in the price variance. But might that be a good thing? It could, if the increase in price causes a corresponding increase in efficiency!

Practice Questions

Candela Citations

- Variable Manufacturing Rate Variances. Authored by: Freedom Learning Group. Provided by: Lumen Learning. License: CC BY: Attribution