Learning Outcomes

- Describe a situation in which job order costing is used

There are two general methods of tracking costs in a manufacturing business: process costing and job order costing.

There are two general methods of tracking costs in a manufacturing business: process costing and job order costing.

Job order costing is a method of cost accumulation used for items or batches of items that are unique—that is, each customer’s order is different. Custom-made kitchen cabinets are an example of a manufactured product that is often customer-specific. Each order is based on different sizes, layouts, wood choices, finishes, hardware, installation costs, customer preferences, etc. No two orders are alike, so the total cost of each order will differ. A single order might involve a homeowner updating her kitchen for a new look. A batch order might be processed for a home builder who is constructing 10 identical homes and therefore requires 10 of the same sets of cabinets. Each single or batch order is referred to as a job and is assigned a unique identification number, such as “Job 15.”

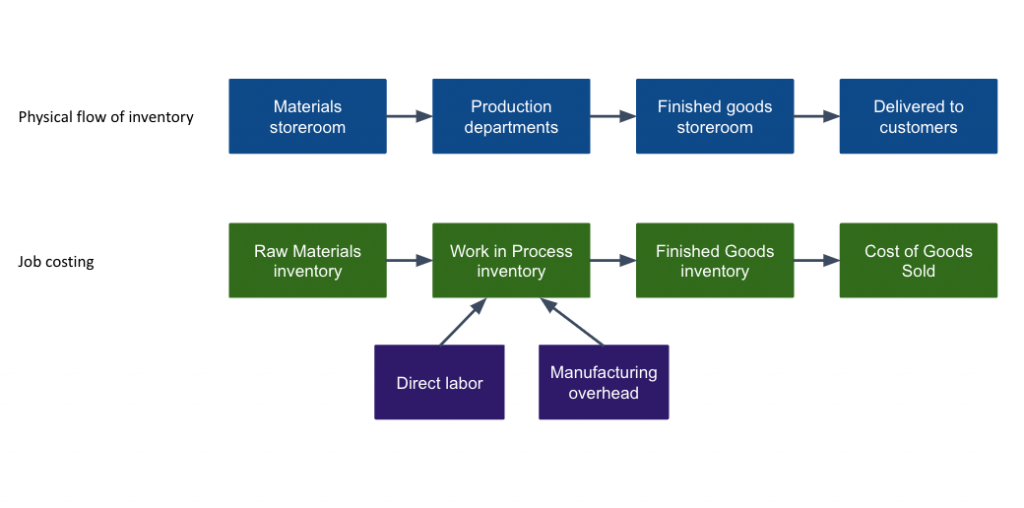

In general, companies match the flow of costs to the physical flow of products through the production process. They place materials received from suppliers in the materials storeroom and record the cost of those materials to raw materials inventory when purchasing them. As they are needed for production, the materials move from the materials storeroom (raw materials inventory) to the production departments with their cost as shown below.

During production, the materials processed by workers and machines become partially manufactured products. At any time during production, these partially manufactured products are collectively known as work in process (or goods in process). For example, if accountants compute the inventory when the company has partially finished products at the end of the year, this inventory is Work in Process Inventory.

Completed products are finished goods. When the products are completed and transferred to the finished goods storeroom, the company removes their costs from Work in Process Inventory and assigns them to Finished Goods Inventory. As the goods are sold, the company transfers related costs from Finished Goods Inventory to Cost of Goods Sold.

Some of the defining characteristics of Job Order Costing include:

- A job consists of a single order or contract. For instance, if Guy Ishiguro accepts a bid from a construction contractor for a bathroom remodel, the contractor would consider that a job and would track costs for that job.

- Each product/job is unique in some way. For instance, a guitar company like Gibson probably does not consider each guitar in the regular production run to be a job, and so uses process costing for most items. However, if someone orders a custom guitar, that could be considered a job and the company would use job order costing to accumulate the costs of that object.

- The costs of each job are ascertained by adding direct materials, direct labor, and allocated overhead. Guy Ishiguro’s bathroom remodel will include direct costs like fixtures and direct labor of the workers, and indirect costs like a supervisor who is overseeing multiple projects, tools, depreciation on equipment, and the contractor’s liability insurance on the workers. However, in job costing, overhead would not normally include general or administrative expenses like office rent, office staff, and selling or marketing expenses, although companies will build those costs into the charges for the job.

- Each order is given a job number or other unique identifier (QuickBooks® uses a Customer:JobName format, such as Ishiguro:Bathroom Remodel.)

- Each job is distinguishable from other jobs, and direct costs can be clearly traced to each job. For example, if the contracting company buys 10 faucets, each faucet used on the Ishiguro remodel project can be traced and assigned directly to that project.

- Costs are accumulated by cross-reference to the job identifier.

- It is possible to identify a job at each stage of the process. In a paper system, each project or job would have a “job card” attached to it (or that follows the job in some manner).

- Jobs are discrete cost objects. By comparing the actual cost of each job against the price charged for each job, management can ascertain the gross profit or loss made on each job.

You can view the transcript for “Job Order Costing” here (opens in new window).

Example

Mitchell Manufacturing is a small company that produces specialty bicycles. Each bicycle is made to order per customer specifications. Orders are taken by the customer service department, and handed off to an engineering support person to configure the job. A parts list is made and then the job is moved to production. Every Monday morning, the engineering group, manufacturing supervisor, and accounting manager meet to go over the orders for the week.

A job number is assigned to each order. Then a bill of materials, or list of the direct materials needed for each bicycle is created. From this list, the purchasing department can get all of the items on order, using a materials requisition form. The accounting department needs to ensure that the job cost sheet is generated, that it includes all of the materials for the job, and that the labor involved and manufacturing overhead is added.

As the job goes through the manufacturing process, each step in the process is added to the job cost sheet which accumulates all of the costs involved in the building of this one job. When the job is completed, the accounting department has all of the information necessary to total the costs involved in making this bike, thus knowing whether the initial price quoted was accurate. This process helps ensure that customers are charged correctly, and allows the company to adjust pricing on future similar jobs if needed.

Job costing is used by a variety of businesses for a variety of reasons and can be an effective method to price products and services.

Practice Questions

Candela Citations

- Job Order Costing. Authored by: Freedom Learning Group. Provided by: Lumen Learning. License: CC BY: Attribution

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution

- Job Order Costing. Authored by: Edspira. Located at: https://youtu.be/Uw_52M9GLbg. License: All Rights Reserved. License Terms: Standard YouTube License

- Job Costing Inventory flowchart. Provided by: Lumen Learning. License: CC BY: Attribution