What you will learn to do: Account for inventory using the periodic method

The term “inventory” can refer to the physical goods on hand in the store or it can refer to the Merchandise Inventory account, which is the financial representation of the physical goods on hand. Ideally, these two things should be the same. The accounting records should, at any point in time, accurately reflect the cost of the physical goods on hand.

In order for that to happen, we have to be constantly adjusting inventory. Before the widespread use of computers, updating inventory for every item sold wasn’t feasible for a lot of businesses. Every time an item is sold, they would have to reduce inventory in their accounting records by the cost of that item. Imagine the raft of accountants at Home Depot trying to make two journal entries every time a sale was made: one to record the sale (debit checking account, credit sales revenue) and the other to record the cost of goods sold (debit cost of goods sold, credit merchandise inventory). Every time someone bought an electrical box, a couple of bolts, a saw, or a stick of lumber, an accountant would have to make those two entries.

That system of updating merchandise inventory for every transaction, in and out, is called the perpetual system. Inventory is perpetually updated. Many, if not most, companies use this system now. When you go to the grocery store and scan a box of cereal or a pound of coffee, the computer does in fact record both the sale of the item and the movement of inventory to cost of goods sold. Presumably (if the system is functioning properly and no one is stealing inventory) the accounting records at any moment in time will accurately reflect the stock in hand. Assume at the beginning of the day, there were 10 bags of Starbucks Kona coffee on the shelf and none in the stock room and the store bought those bags for $9 each. Customers buy eight bags. At the end of the day, if you check the accounting records, the inventory subsidiary ledger will show two bags at $9 each (cost) for a total of $18. A quick check of the shelf also would reveal two bags of coffee (but not the cost—that’s just in the accounting records). Computers are now doing all those calculations we couldn’t possibly do before, and they are doing them quickly and accurately.

The alternative way of updating inventory, and therefore cost of goods sold, is called the periodic method. You’ve used this method before, with the supplies account, so let’s review.

Let’s say you start the month with $250 in the supplies account, based on last month’s ending balance, which was based on a count of the supplies on hand and some assignment of cost to those supplies. Let’s say it was a toner cartridge that cost $200, and five reams of paper that cost $10 each. During the month, the company bought two more toner cartridges at $200 each, and a case of paper (10 reams) for $110.

| Toner cartridges | Reams of paper | Total cost | |

|---|---|---|---|

| Beginning supplies | 1 @ $200 ea = $200 | 5 @ $10 ea = $50 | $250 |

| Purchased | 2 @ $200 ea = $400 | 10 @ $11 ea = $110 | $510 |

| Total supplies available for use during the month | 3 cartridges that cost $600 total | 15 reams of paper that cost $160 total | $760 |

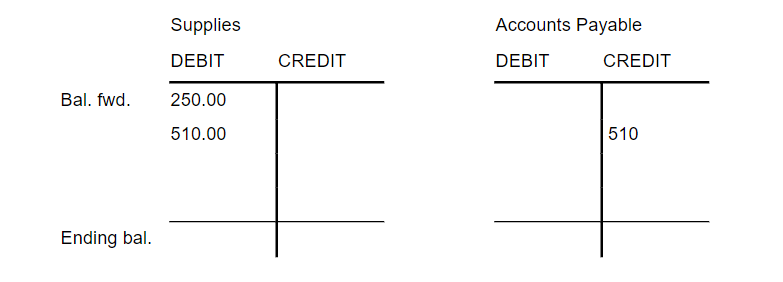

Our ledger accounts would look like this:

During the month, people used up (expended) supplies but we didn’t bother accounting for each piece of paper, or even each toner cartridge. In a big business, this account would have so many supplies it would be like accounting for each sip of water an employee took from the fountain. Too much cost for not much benefit.

Instead, we periodically count the ending supplies “inventory,” and then we back into the cost of supplies used. What we started with (beginning inventory) plus purchases gives us what we would have on hand if we didn’t use any. Subtract what’s left at the end of the period, and we know what was used up (some of it may have been stolen or otherwise used for personal, non-business purposes, but without some other form of internal control, we have no way of knowing that).

So, back to our supplies example. Assume at the end of the month, there is one toner cartridge left and three reams of paper. Let’s also assume we figure those three reams were the $11 ones, not the $10 ones (assuming we use the oldest reams of paper first, which may or may not be the case):

| Toner cartridges | Reams of paper | Total cost | ||

|---|---|---|---|---|

| (a) | Beginning supplies | 1 @ $200 ea = $200 | 5 @ $10 ea = $50 | $250 |

| (b) | Purchased | 2 @ $200 ea = $400 | 10 @ $11 ea = $110 | $510 |

| (a + b) | Total supplies available for use during the month | 3 cartridges that cost $600 total | 15 reams of paper that cost $160 total | $760 |

| (c) | Supplies at the end of the month | 1 @ $200 ea = $200 | 3 @ $11 ea = $33 | $233 |

| (a + b – c) | Supplies used up | 2 @ $200 ea = $400 | 5 @ $10 ea = $50 7 @ $11 ea = $77 |

$527 |

Our ledger accounts would look like this:

This example is the periodic method of accounting. We adjust the asset account to match reality, and the difference is what we used up (or sold, in the case of merchandise inventory). Here, we used it for supplies, but for years and years, most companies used this same method to calculate cost of goods sold.

Still, merchandising companies selling low unit value merchandise (such as nuts and bolts, nails, Christmas cards, or pencils) that have not computerized their inventory systems often find the extra costs of record-keeping under perpetual inventory procedure more than outweighs the benefits. These merchandising companies often use the periodic inventory procedure. We’re going to study the periodic inventory procedure first because it’s simpler to understand. Once you get the hang of the periodic system, you just need to make some mental adjustments and think more like a computer in order to grasp the perpetual system.