Learning Outcomes

- Explain why consumer protection legislation is needed

- Summarize several consumer protection laws

Importance of Consumer Protection Law

Accounting for roughly 70% of GDP in 2018, consumer spending is essential to the health of the U.S. economy and the country’s relative political stability, prosperity, and quality of life. What would happen if the American consumer lost faith in manufacturers… in retailers… in providers of goods and services ranging from aircraft and automobiles to a broad range of agricultural and consumer packaged goods? That would put the $13 trillion consumers spent in 2018 at risk.

Accounting for roughly 70% of GDP in 2018, consumer spending is essential to the health of the U.S. economy and the country’s relative political stability, prosperity, and quality of life. What would happen if the American consumer lost faith in manufacturers… in retailers… in providers of goods and services ranging from aircraft and automobiles to a broad range of agricultural and consumer packaged goods? That would put the $13 trillion consumers spent in 2018 at risk.

For perspective, that dollar figure dwarfs the (albeit substantial) $700 billion the Treasury spent on the 2008 bank bailout. The lack of ethics, ineffective standards, and outright fraud that contributed to the economic crisis isn’t limited to the financial sector. The U.S. Food and Drug Administration and the U.S. Department of Agriculture’s Food Safety and Inspection Service reported 456 food recalls in 2017.[1] In the consumer durables category, The National Highway Traffic Safety Administration reported 30.7 million motor vehicle recalls in 2017. Forbes contributor Jim Gorzelany puts that in perspective, noting that with 17.6 million new vehicles sold in 2017, the industry recalled approximately 74% more cars and truck than it delivered.[2]

Clearly, caveat emptor, a Latin term translated as “let the buyer beware,” applies as much to modern commerce as it did when it first emerged as a legal principle in a 1603 case that drew a distinction between warranties and affirmations. However, this phrase is insufficient for consumer safety, and consumer protections are essential to maintain consumer confidence and the health of the economy and society.

Practice Question

Consumer Protection Laws

There are several consumer protection laws. In the United States, these laws are mainly enforced by The Federal Trade Commission, Consumer Financial Protection Bureau, FDA, & US Department of Justice. Consumer protection legislation includes statutes that address the following:

There are several consumer protection laws. In the United States, these laws are mainly enforced by The Federal Trade Commission, Consumer Financial Protection Bureau, FDA, & US Department of Justice. Consumer protection legislation includes statutes that address the following:

- Product Safety

- Consumer Credit

- Automotive Safety

Product Safety

The federal Consumer Product Safety Act (CPSA) established the Consumer Product Safety Commission and authorized the agency to develop and enforce standards, including the right to ban products.[3]

The federal Food and Drug Act (FDA) mandates regulation of food, drugs, cosmetics, biologics, medical products, and tobacco. The FDA’s authority includes public education, investigation, and enforcement.

Consumer Credit

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. The act requires credit reporting agencies, such as Experian and Transunion, to allow consumers to review their credit data on file and to verify any information disputed by a consumer. Here are some excerpts from the FTC’s summary of rights under the act:

- You must be told if information in your file has been used against you.

- You have the right to know what is in your file.

- You have the right to dispute incomplete or inaccurate information.

An amendment to the law, the Fair and Accurate Credit Transactions Act, allows consumers to obtain one free credit report (not to be confused with your credit score) annually. To request your free report, visit www.annualcreditreport.com.

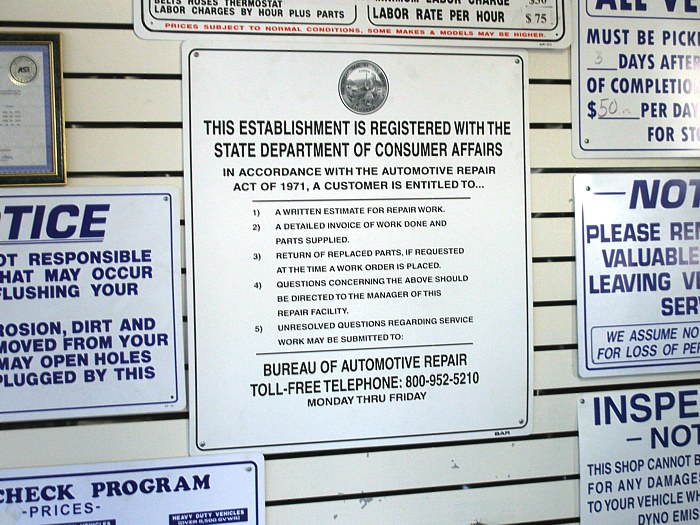

Automotive Safety

The Highway Safety Act established the National Highway Traffic Safety Administration (NHTSA), an organization charged with “promoting vehicle safety innovations, addressing vehicle defects, setting safety standards for cars and trucks, and educating Americans to help them make safer choices when driving, riding, or walking.”[4]

Although deceptive trade practices are addressed under antitrust legislation, it’s worth highlighting California’s Consumers Legal Remedies Act, which identifies a broad range of unfair methods of competition and unfair or deceptive acts or practices used in the sale or lease of consumer goods or services and allows consumers to sue to recover damages and stop the prohibited practices.[5]

Practice Question

- Maberry, Tiffany. "A Look Back at 2017 Food Recalls." Food Safety Magazine. February 6, 2018. Accessed June 12, 2019. https://www.foodsafetymagazine.com/enewsletter/a-look-back-at-2017-food-recalls/. ↵

- Gorzelany, Jim. "Auto Recalls Hit A Four-Year Low Last Year, But Still Exceed Units Sold." Forbes. March 13, 2018. Accessed June 12, 2019. https://www.forbes.com/sites/jimgorzelany/2018/03/13/auto-recalls-hit-a-four-year-low-last-year-still-exceed-units-sold/. ↵

- "Consumer Product Safety Act." Consumer Product Safety Commission. August 12, 2011. Accessed June 12, 2019. https://www.cpsc.gov/PageFiles/105435/cpsa.pdf. ↵

- "Understanding the National Highway Traffic Safety Administration (NHTSA)." US Department of Transportation. January 26, 2017. Accessed June 12, 2019. https://www.transportation.gov/transition/understanding-national-highway-traffic-safety-administration-nhtsa. ↵

- "Civil Code CIV - Division 3 - Part 4 - Title 1.5 - Chapter 3." California Legislative Information. Accessed June 12, 2019. https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=CIV&division=3.&title=1.5.&part=4.&chapter=3.&article=. ↵