Learning Objectives

- Contrast and classify monies as either M1 money supply and M2 money supply

Measuring Money: Currency, M1, and M2

We defined money as anything that is generally accepted as a means of payment, is a store of value, can be used as a unit of account or a standard of deferred payment. What exactly is included?

Cash in your pocket certainly serves as money; however, what about checks or credit cards? Are they money, too? Rather than trying to state a single way of measuring money, economists offer broader definitions of money based on liquidity. Liquidity refers to how quickly you can use a financial asset to buy a good or service. For example, cash is very liquid. You can use your $10 bill easily to buy a hamburger at lunchtime. However, $10 that you have in your savings account is not so easy to use. You must go to the bank or ATM machine and withdraw that cash to buy your lunch. Thus, $10 in your savings account is less liquid.

The Federal Reserve Bank, which is the central bank of the United States, is a bank regulator and is responsible for monetary policy and defines money according to its liquidity. There are two definitions of money: M1 and M2 money supply.

Historically, M1 money supply included those monies that are very liquid such as cash, checkable (demand) deposits, and traveler’s checks, while M2 money supply included those monies that are less liquid in nature; M2 included M1 plus savings and time deposits, certificates of deposits, and money market funds. Beginning in May 2020, the Federal Reserve changed the definition of both M1 and M2. The biggest change is that savings moved to be part of M1. M1 money supply now includes cash, checkable (demand) deposits, and savings. M2 money supply is now measured as M1 plus time deposits, certificates of deposits, and money market funds.

M1

M1 money supply includes coins and currency in circulation—the coins and bills that circulate in an economy that the U.S. Treasury does not hold at the Federal Reserve Bank, or in bank vaults. Closely related to currency are checkable deposits, also known as demand deposits. These are the amounts held in checking accounts. They are called demand deposits or checkable deposits because the banking institution must give the deposit holder his money “on demand” when the customer writes a check or uses a debit card. These items together—currency, and checking accounts in banks—comprise the definition of money known as M1, which the Federal Reserve System measures daily.

As mentioned, M1 now includes savings deposits in banks, which are bank accounts on which you cannot write a check directly, but from which you can easily withdraw the money at an automatic teller machine or bank.

M2

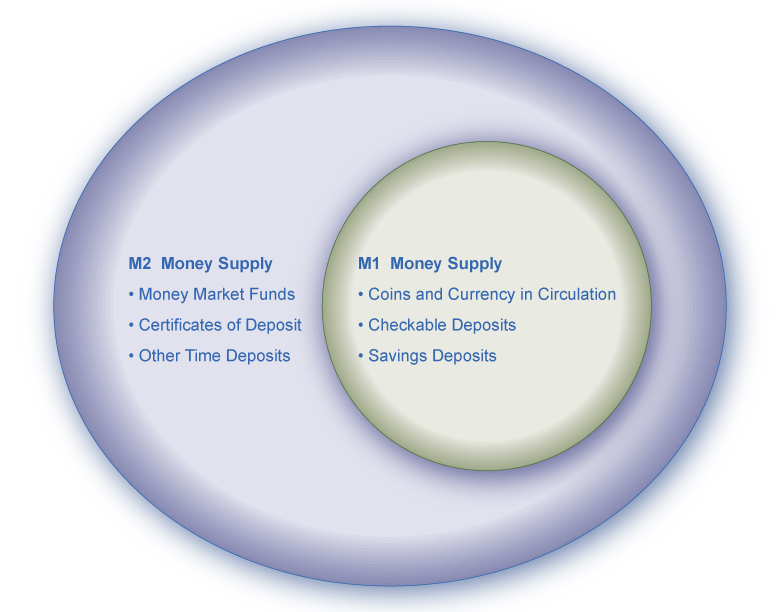

A broader definition of money, M2 includes everything in M1 but also adds other types of deposits. Many banks and other financial institutions also offer a chance to invest in money market funds, where they pool together the deposits of many individual investors and invest them in a safe way, such as short-term government bonds. Another ingredient of M2 are the relatively small (that is, less than about $100,000) certificates of deposit (CDs) or time deposits, which are accounts that the depositor has committed to leaving in the bank for a certain period of time, ranging from a few months to a few years, in exchange for a higher interest rate. In short, all these types of M2 are money that you can withdraw and spend, but which require a greater effort to do so than the items in M1. Figure 14.3 should help in visualizing the relationship between M1 and M2. Note that M1 is included in the M2 calculation.

Figure 1. The Relationship between M1 and M2 Money. M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks + saving deposits. M2 = M1 + money market funds + certificates of deposit + other time deposits.

The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply. To provide an idea of what these amounts sound like, according to the Federal Reserve Bank’s measure of the U.S. money stock, at the end of November 2021, M1 in the United States was $20.3 trillion, while M2 was $21.4 trillion. The table provides a breakdown of the portion of each type of money that comprised M1 and M2 in November 2021, as provided by the Federal Reserve Bank.

| Table 1. M1 and M2 Federal Reserve Statistical Release, Money Stock Measures (Source: Federal Reserve Statistical Release, http://www.federalreserve.gov/RELEASES/h6/current/default.htm#t2tg1link) |

|

| Components of M1 in the U.S. (November 2021, Seasonally Adjusted) | $ billions |

| Currency | $2,114.6 |

| Demand deposits | $4,764.1 |

| Savings and other liquid deposits | $13,466.3 |

| Total M1 | $20,345 (or $21.4 trillion) |

| Components of M2 in the U.S. (November 2021, Seasonally Adjusted) | $ billions |

| M1 money supply | $19,221 |

| Small-denomination time deposits | $120 |

| Retail money market fund balances | $1,027 |

| Total M2 | $20,368 (or $20 trillion) |

The lines separating M1 and M2 can become a little blurry. Sometimes businesses do not treat elements of M1 alike. For example, some businesses will not accept personal checks for large amounts, but will accept traveler’s checks or cash. Changes in banking practices and technology have made the savings accounts in M2 more similar to the checking accounts in M1. For example, some savings accounts will allow depositors to write checks, use automatic teller machines, and pay bills over the internet, which has made it easier to access savings accounts. As with many other economic terms and statistics, the important point is to know the strengths and limitations of the various definitions of money, not to believe that such definitions are as clear-cut to economists as, say, the definition of nitrogen is to chemists.

Where does “plastic money” like debit cards, credit cards, and smart money fit into this picture? A debit card, like a check, is an instruction to the user’s bank to transfer money directly and immediately from your bank account to the seller. It is important to note that in our definition of money, it is checkable deposits that are money, not the paper check or the debit card. Although you can make a purchase with a credit card, the financial institution does not consider it money but rather a short term loan from the credit card company to you. When you make a credit card purchase, the credit card company immediately transfers money from its checking account to the seller, and at the end of the month, the credit card company sends you a bill for what you have charged that month. Until you pay the credit card bill, you have effectively borrowed money from the credit card company. With a smart card, you can store a certain value of money on the card and then use the card to make purchases. Some “smart cards” used for specific purposes, like long-distance phone calls or making purchases at a campus bookstore and cafeteria, are not really all that smart, because you can only use them for certain purchases or in certain places.

In short, credit cards, debit cards, and smart cards are different ways to move money when you make a purchase. However, having more credit cards or debit cards does not change the quantity of money in the economy, any more than printing more checks increases the amount of money in your checking account.

One key message underlying this discussion of M1 and M2 is that money in a modern economy is not just paper bills and coins. Instead, money is closely linked to bank accounts. The banking system largely conducts macroeconomic policies concerning money.

Try It

Try It

These questions allow you to get as much practice as you need, as you can click the link at the top of the first question (“Try another version of these questions”) to get a new set of questions. Practice until you feel comfortable doing the questions.

Glossary

- coins and currency in circulation:

- the coins and bills that circulate in an economy that are not held by the U.S Treasury, at the Federal Reserve Bank, or in bank vaults

- credit card:

- immediately transfers money from the credit card company’s checking account to the seller, and at the end of the month the user owes the money to the credit card company; a credit card is a short-term loan

- debit card:

- like a check, is an instruction to the user’s bank to transfer money directly and immediately from your bank account to the seller

- demand deposit:

- checkable deposit in banks that is available by making a cash withdrawal or writing a check

- liquidity:

- how quickly and easily an asset can be converted to a means of payment to make a purchase

- M1 money supply:

- a narrow definition of the money supply that includes currency and checking accounts in banks, savings accounts, and to a lesser degree, traveler’s checks.

- M2 money supply:

- a definition of the money supply that includes everything in M1, but also adds other deposits, money market funds, and certificates of deposit

- money market fund:

- the deposits of many investors are pooled together and invested in a safe way like short-term government bonds

- savings deposit:

- bank account where you cannot withdraw money by writing a check, but can withdraw the money at a bank—or can transfer it easily to a checking account

- smart card:

- stores a certain value of money on a card and then one can use the card to make purchases

- time deposit:

- account that the depositor has committed to leaving in the bank for a certain period of time, in exchange for a higher rate of interest; also called certificate of deposit

Candela Citations

- Modification, adaptation, and original content. Provided by: Lumen Learning. License: CC BY: Attribution

- Measuring Money: Currency, M1, and M2. Authored by: OpenStax College. Provided by: Rice University. Located at: https://cnx.org/contents/vEmOH-_p@4.4:yseWZpUg/Measuring-Money-Currency-M1-an. License: CC BY: Attribution. License Terms: Download for free at http://cnx.org/donate/download/4061c832-098e-4b3c-a1d9-7eb593a2cb31@10.49/pdf