What you will learn to do: account for completed jobs

At the end of each accounting period, which may be monthly or quarterly, management will want to see progress reports on all the jobs. Completed jobs will be closed out, and jobs in process will be analyzed to see if they are on track. For instance, a construction company may be building bridges, office buildings, and other large projects, all in different states of completion, and you, as the managerial accountant, will have to prepare the job reports for each. In fact, you may have to create a report at mid-month or at other odd times, depending on the circumstances. In any case, before creating these reports, managerial accountants need to make sure all relevant costs, including overhead, have been accounted for.

When you are done with this section, you will be able to:

- Record completion and sales of finished goods

- Adjust for over and under-allocated overhead

Learning Activities

The learning activities for this section include the following:

- Reading: Accounting for Completed Jobs

- Self Check: Accounting for Completed Jobs

- Reading: Over and Under-allocated Overhead

- Self Check: Over and Under-allocated Overhead

Candela Citations

- Introduction to Month-end Reporting. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

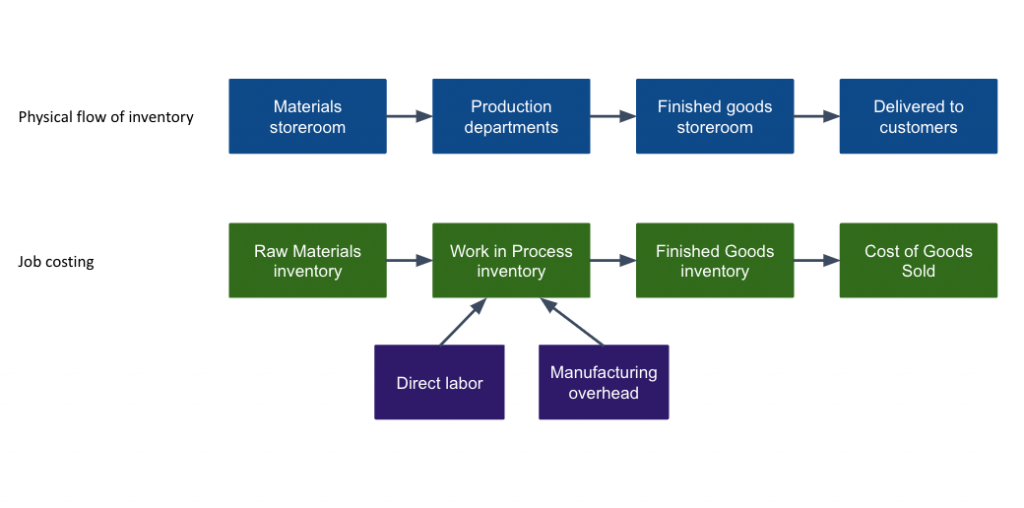

- Job costing inventory flowchart. Provided by: Lumen Learning. License: CC BY: Attribution