Learning Outcomes

- Identify business trends that affect managerial accounting

Financial accounting is regulated by the Securities and Exchange Commission and the Financial Accounting Standards Board, which issues Generally Accepted Accounting Principles. Changes to financial accounting then are mandated by those statements of GAAP.

Managerial accounting, on the other hand, has no rules. It is, however, influenced by current managerial philosophies and trends. The managerial accountant has to stay current on the best practices in whatever industry the company is in and has to stay flexible and responsive, even innovative.

Managerial accounting, on the other hand, has no rules. It is, however, influenced by current managerial philosophies and trends. The managerial accountant has to stay current on the best practices in whatever industry the company is in and has to stay flexible and responsive, even innovative.

Here are some of the common management philosophies that affect managerial accounting today.

Total Quality Management (TQM)

Total quality management is continually detecting and reducing or eliminating errors in manufacturing, streamlining supply chain management, improving the customer experience, and ensuring that employees are up to speed with training. It also means holding all parties involved in the production process accountable for the overall quality of the final product or service.

TQM was developed by William Deming, a management consultant whose work had a great impact on Japanese manufacturing. There are some similar philosophies, such as Six Sigma (defect reduction strategy) and Kaizen (gradual, continuous improvement), and multiple variations of all of these.

Value Chain

A value chain is a set of interrelated activities a company uses to create a competitive advantage. The business receives raw materials, adds value to them through production, manufacturing, and other processes to create a finished product, and then sells the finished product to consumers. Think back to Harley-Davidson. A box of parts arrives at the factory. Workers assemble the motorcycle. A sales and delivery force gets the finished product to the dealers. That is the value chain. The parts by themselves may only be worth a few thousand dollars, but the finished product is worth far more than that and hopefully results in a profit for the company.

Supply chain management is related to the value chain. It involves the active streamlining of a business’s supply-side activities (for instance, obtaining raw materials) to maximize customer value and gain a competitive advantage in the marketplace.

Triple Bottom Line

British management consultant and sustainability guru John Elkington coined the phrase “triple bottom line” as a way of measuring a commitment to social responsibility (people) and environmental responsibility (sustainability) as well as profits.

Enterprise Resource Planning (ERP)

Enterprise Resource Planning refers to software and systems used to plan and manage all the core supply chain, manufacturing, services, financial, and other processes by connecting every aspect of an enterprise.

Early computer systems were not integrated. The accounting software was separate from human resources. Budgeting was done on spreadsheets. Production schedules would be on another platform. However, as technology has developed, more and more of these systems are being designed to interface with each other and even to use common databases. ERP is the next logical evolution, where one system handles all of the data and reporting.

Just-in-Time management (JIT)

The just-in-time (JIT) inventory system aligns raw-material orders from suppliers directly with production schedules. Companies employ this inventory strategy to increase efficiency and decrease waste by receiving goods only as they need them for the production process, which reduces inventory costs. This method requires the managerial accountant to accurately forecast demand.

This is just a sample of the many business philosophies that affect managerial accountants.

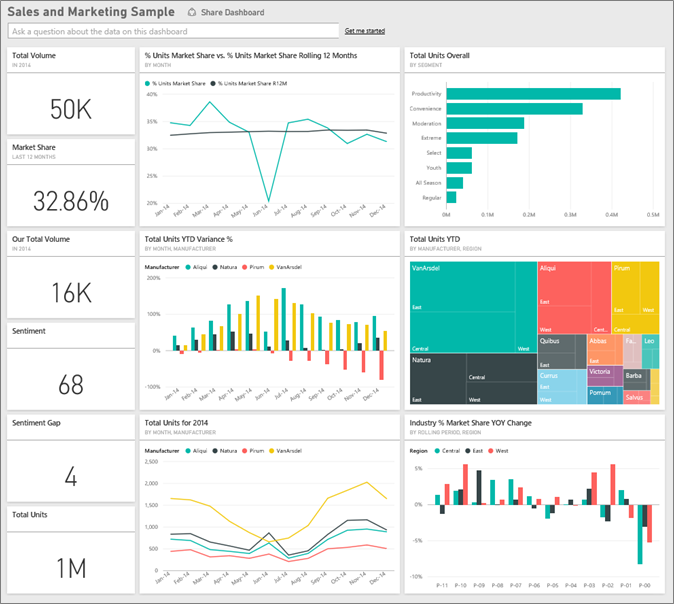

As you may have noticed, technology is a driving force behind many of these business trends. Managers depend upon relevant, reliable, and current data in order to manage things like JIT, making software solutions an essential element of the managerial accounting toolbox. For instance, software such as Microsoft Power BI allows accountants and managers to create custom dashboards, like this one:

A dashboard gives management a way to visually assess progress against the plan and to focus on a few, key metrics, similar to the way a driver would look at the speedometer, the fuel gauge, and the odometer on an automobile dashboard. If a red light comes on or an indicator shows something amiss, the manager can drill down into that data to see what needs to happen to correct the problem.

Ethics

Managerial accountants face many choices involving ethics. For example, managers are responsible for achieving financial targets such as net income. Managers who fail to achieve these targets may lose their jobs. If a division or company is having trouble achieving financial performance targets, managers may be tempted to act unethically. For instance, a manager may attempt to manipulate the accounting numbers in order to get a bonus.

In 2012, the globally-based Chartered Institute of Management Accountants (CIMA) joined with the American Institute of Certified Public Accountants (AICPA) to establish the Chartered Global Management Accountant (CGMA) designation. The CGMA designation distinguishes professionals who have advanced proficiency in finance, operations, strategy and management. The Institute of Management Accountants (IMA) is another representative group for the managerial accounting profession. IMA‘s overarching ethical principles include: Honesty, Fairness, Objectivity, and Responsibility. Many IMA members have earned the Certified Management Accountant (CMA) and Certified Financial Manager (CFM) designations. These certificates represent significant competencies in managerial accounting and financial management skills, as well as a pledge to follow the ethical precepts of the IMA.

In its Standards of Ethical Conduct for Management Accountants, the Institute of Management Accountants (IMA) states that management accountants have an obligation to maintain the highest levels of ethical conduct by maintaining professional competency, refraining from disclosing confidential information, and maintaining integrity and objectivity in their work. www.imanet.org

The standards recommend that people faced with ethical conflicts follow the company’s established policies that deal with such conflicts. If the policies do not resolve the conflict, accountants should consider discussing the matter with their superiors, potentially going as high as the audit committee of the board of directors. In extreme cases, the accountants may have no alternative but to resign.

Now, check your understanding of business trends that affect managerial accounting:

Practice Question

Candela Citations

- Business Trends. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Sticky note business management. Provided by: Picpedia.org. Located at: https://www.picpedia.org/post-it-note/b/business-management.html. License: CC BY-SA: Attribution-ShareAlike

- Microsoft Power BI Dashboard. Authored by: Microsoft. Provided by: Microsoft. Located at: https://docs.microsoft.com/en-us/power-bi/create-reports/sample-sales-and-marketing. License: All Rights Reserved