Learning Outcomes

- Identify the characteristics of job costing

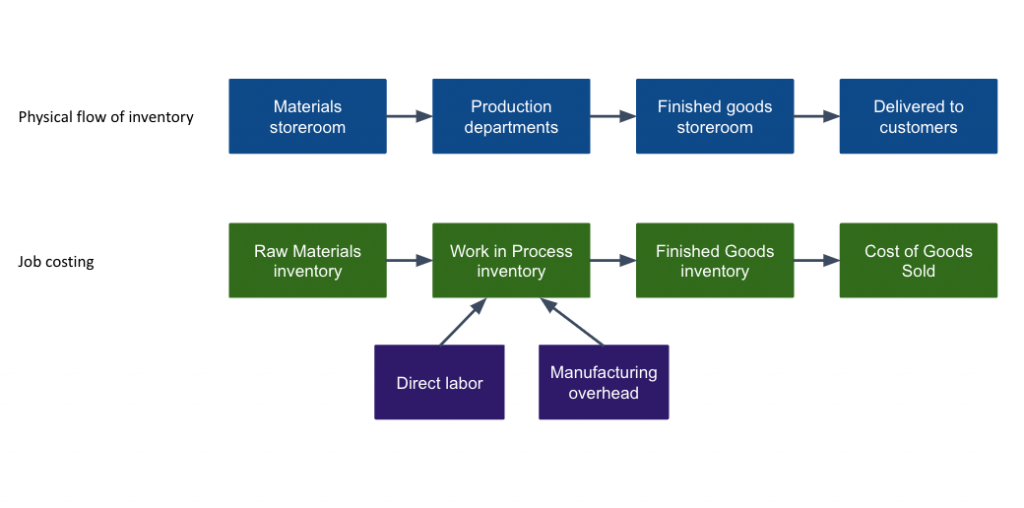

In general, companies match the flow of costs to the physical flow of products through the production process. They place materials received from suppliers in the materials storeroom and record the cost of those materials to raw materials inventory when purchasing them. As they are needed for production, the materials move from the materials storeroom (raw materials inventory) to the production departments with their cost as shown below.

During production, the materials processed by workers and machines become partially manufactured products. At any time during production, these partially manufactured products are collectively known as work in process (or goods in process). For example, if accountants compute the inventory when the company has partially finished products at the end of the year, this inventory is Work in Process Inventory.

Completed products are finished goods. When the products are completed and transferred to the finished goods storeroom, the company removes their costs from Work in Process Inventory and assigns them to Finished Goods Inventory. As the goods are sold, the company transfers related costs from Finished Goods Inventory to Cost of Goods Sold.

Some of the defining characteristics of Job Order Costing include:

- A job consists of a single order or contract. For instance, if Guy Ishiguro accepts a bid from a construction contractor for a bathroom remodel, the contractor would consider that a job and would track costs for that job.

- Each product/job is unique in some way. For instance, a guitar company like Gibson probably does not consider each guitar in the regular production run to be a job, and so uses process costing for most items. However, if someone orders a custom guitar, that could be considered a job and the company would use job order costing to accumulate the costs of that object.

- The costs of each job are ascertained by adding direct materials, direct labor, and allocated overhead. Guy Ishiguro’s bathroom remodel will include direct costs like fixtures and direct labor of the workers, and indirect costs like a supervisor who is overseeing multiple projects, tools, depreciation on equipment, and the contractor’s liability insurance on the workers. However, in job costing, overhead would not normally include general or administrative expenses like office rent, office staff, and selling or marketing expenses, although companies will build those costs into the charges for the job.

- Each order is given a job number or other unique identifier (QuickBooks® uses a Customer:JobName format, such as Ishiguro:Bathroom Remodel.)

- Each job is distinguishable from other jobs, and direct costs can be clearly traced to each job. For example, if the contracting company buys 10 faucets, each faucet used on the Ishiguro remodel project can be traced and assigned directly to that project.

- Costs are accumulated by cross-reference to the job identifier.

- It is possible to identify a job at each stage of the process. In a paper system, each project or job would have a “job card” attached to it (or that follows the job in some manner).

- Jobs are discrete cost objects. By comparing the actual cost of each job against the price charged for each job, management can ascertain the gross profit or loss made on each job.

You can view the transcript for “Job Order Costing” here (opens in new window).

Practice Question

Candela Citations

- Characteristics of Job Order Costing. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution

- Job Order Costing. Provided by: Education Unlocked. Located at: https://youtu.be/Uw_52M9GLbg. License: All Rights Reserved. License Terms: Standard YouTube License

- Job Costing Inventory flowchart. Provided by: Lumen Learning. License: CC BY: Attribution