The political economy of a country refers to its political and economic systems, together. The political system includes the set of formal and informal legal institutions and structures that comprise the government or state and its sovereignty over a territory or people. As you know, political systems can differ in the way they view the role of government and the rights of citizens (compare, for example, the democratic political system of Canada with the communist system of North Korea). As you’ll recall, the economic system refers to the way in which a country organizes its economy: most are command, market, or mixed economies.

The nature of a country’s political economy plays a big role in whether it is attractive to foreign business and entrepreneurship. Historically, there has been a direct relationship between the degree of economic freedom in a country and its economic growth—the more freedom, the more growth, and vice versa. For decades, the Chinese government maintained an ironclad grip on all business enterprise, which effectively prevented foreign businesses from fully engaging with the Chinese market. That climate has tempered, however, and now the political economy of China is much more open to foreign investment, though it is still not as open as Europe or the U.S.

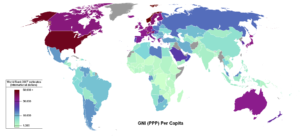

Businesses seeking global opportunities must consider other economic factors beyond a country’s political economy. For one thing, they will want to target the markets and countries where people have the highest incomes and the most disposable income. The world map below shows just how much variation there is in the gross national income (GNI) per person among the nations of the world.

However, often those markets are not where new opportunity exists, so businesses have to pursue what economists refer to as “emerging markets.” The four largest emerging and developing economies are the BRIC countries (Brazil, Russia, India, and China). One means of measuring a country’s level of economic development is by its purchasing power parity (PPP), which enables economists to compare countries with very different standards of living. The PPP for a given country is determined by adjusting up or down as compared to the cost of living in the United States.

India has the world’s second-largest mobile-phone user base: 996.66 million users as of September 2015. Shown here is a rooftop mobile phone tower in Bangalore.

However, there is often more to a country’s economic story than its PPP or GNI. Consider India: As an emerging market, India is attracting significant attention from businesses all around the globe. It has the second-fastest-growing automotive industry in the world. According to a 2011 report, India’s GDP at purchasing power parity could overtake that of the United States by 2045. During the next four decades, Indian GDP is expected to grow at an annualized average of 8 percent, making it potentially the world’s fastest-growing major economy until 2050. The report highlights key growth factors: a young and rapidly growing working-age population; growth in the manufacturing sector because of rising education and engineering skill levels; and sustained growth of the consumer market driven by a rapidly growing middle class.

At the same time, surveys continue to emphasize the chasm between two contrasting pictures of India—on one side, an urban India, which boasts of large-scale space and nuclear programs, billionaires, and information technology expertise, and a rural India on the other, in which 92 million households (51 percent) earn their living by manual labor. In 2014, a report by the Indian Government Planning Commission estimated that 363 million Indians, or 29.5 percent of the total population, were living below the poverty line.

Another aspect of a country’s political economy is the stability of its current government. Business activity tends to grow and thrive when a country is politically stable. When a country is politically unstable, multinational firms can still conduct business profitably, but there are higher risks and often higher costs associated with business operations. Political instability makes a country less attractive from a business investment perspective, so foreign and domestic companies doing business there must often pay higher insurance rates, higher interest rates on business loans, and higher costs to protect the security of their employees and operations. Alternatively, in countries with stable political environments, the market and consumer behavior are more predictable, and organizations can rely on governments to enforce the rule of law.

As you can see, the desirability of a country as a potential market or investment site depends on a host of complex, interrelated factors. To further complicate matters, once a business arrives in a foreign market, it must also contend with the uncertainty of exchange rates. An exchange rate is the value of one country’s currency relative to the value of another country’s currency. For example, an exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1, or US$1 will be exchanged for ¥119.

Each country, using various mechanisms, manages the value of its currency. A market-based exchange rate will change whenever the value of either of the two component currencies change. A currency will tend to become more valuable whenever demand for it is greater than the available supply. It will become less valuable whenever demand is less than the available supply (this does not mean that people no longer want money, only that they prefer to hang on to their wealth in some other form, possibly another currency).

The video below will provide a complete picture of exchange rates and how they impact trade:

Clearly, exchanges rates are an important consideration for companies wanting to take their business global, since they will likely have to buy and sell even the most mundane commodities once they arrive in the foreign market. Local labor wants to be paid in its nation’s currency, and if the exchange rate of that currency changes in a way that makes it more valuable, then the business’s costs rise unexpectedly. Although businesses try to anticipate and plan for fluctuations in exchange rates, currency values are determined by supply and demand, and businesses are at the mercy of market forces beyond their control.