Risk

Investment risk is the idea that an investment will not perform as expected, that its actual return will deviate from the expected return. Risk is measured by the amount of volatility, that is, the difference between actual returns and average (expected) returns. This difference is referred to as the standard deviation. Returns with a large standard deviation (showing the greatest variance from the average) have higher volatility and are the riskier investments.

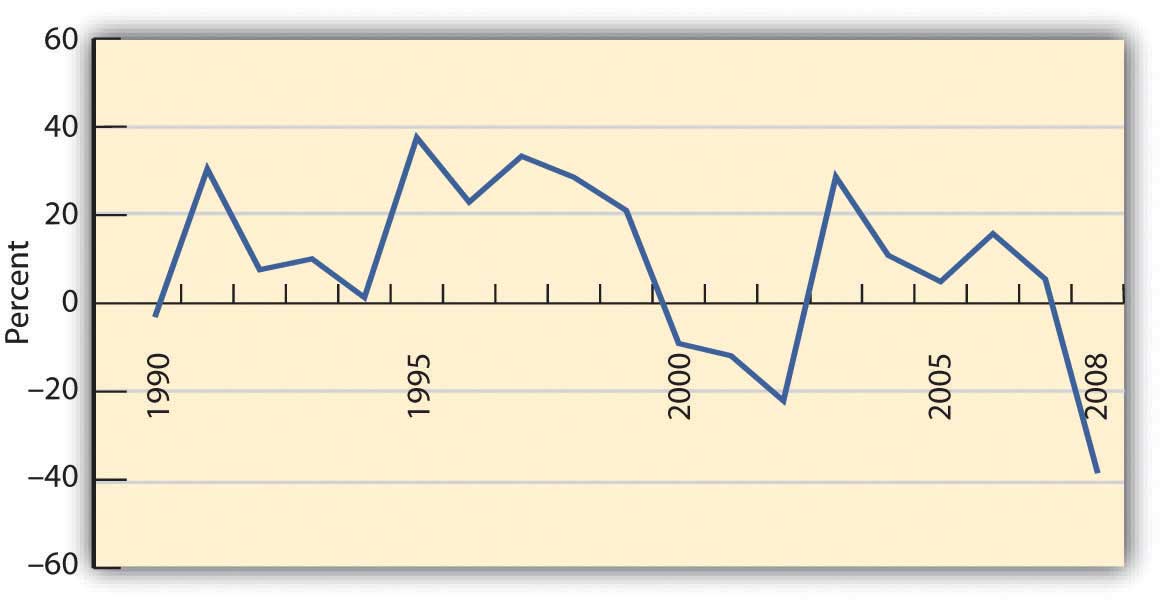

Figure 2. S&P 500 Average Annual Return Based on data from Standard & Poor’s, Inc., (accessed November 24, 2009).

As Figure 2 shows, an investment may do better or worse than its average. Thus, standard deviation can be used to define the expected range of investment returns. For the S&P 500, for example, the standard deviation from 1990 to 2008 was 19.54 percent. So, in any given year, the S&P 500 is expected to return 9.16 percent but its return could be as high as 67.78 percent or as low as −49.46 percent, based on its performance during that specific period.

What risks are there? What would cause an investment to unexpectedly over- or underperform? Starting from the top (the big picture) and working down, there are

- economic risks,

- industry risks,

- company risks,

- asset class risks,

- market risks.

Economic risks are risks that something will upset the economy as a whole. The economic cycle may swing from expansion to recession, for example; inflation or deflation may increase, unemployment may increase, or interest rates may fluctuate. These macroeconomic factors affect everyone doing business in the economy. Most businesses are cyclical, growing when the economy grows and contracting when the economy contracts.

Consumers tend to spend more disposable income when they are more confident about economic growth and the stability of their jobs and incomes. They tend to be more willing and able to finance purchases with debt or with credit, expanding their ability to purchase durable goods. So, demand for most goods and services increases as an economy expands, and businesses expand too. An exception is businesses that are countercyclical. Their growth accelerates when the economy is in a downturn and slows when the economy expands. For example, low-priced fast food chains typically have increased sales in an economic downturn because people substitute fast food for more expensive restaurant meals as they worry more about losing their jobs and incomes.

Industry risks usually involve economic factors that affect an entire industry or developments in technology that affect an industry’s markets. An example is the effect of a sudden increase in the price of oil (a macroeconomic event) on the airline industry. Every airline is affected by such an event, as an increase in the price of airplane fuel increases airline costs and reduces profits. An industry such as real estate is vulnerable to changes in interest rates. A rise in interest rates, for example, makes it harder for people to borrow money to finance purchases, which depresses the value of real estate.

Company risk refers to the characteristics of specific businesses or firms that affect their performance, making them more or less vulnerable to economic and industry risks. These characteristics include how much debt financing the company uses, how well it creates economies of scale, how efficient its inventory management is, how flexible its labor relationships are, and so on.

The asset class that an investment belongs to can also bear on its performance and risk. Investments (assets) are categorized in terms of the markets they trade in. Broadly defined, asset classes include

- corporate stock or equities (shares in public corporations, domestic, or foreign);

- bonds or the public debts of corporation or governments;

- commodities or resources (e.g., oil, coffee, or gold);

- derivatives or contracts based on the performance of other underlying assets;

- real estate (both residential and commercial);

- fine art and collectibles (e.g., stamps, coins, baseball cards, or vintage cars).

Within those broad categories, there are finer distinctions. For example, corporate stock is classified as large cap, mid cap, or small cap, depending on the size of the corporation as measured by its market capitalization (the aggregate value of its stock). Bonds are distinguished as corporate or government and as short-term, intermediate-term, or long-term, depending on the maturity date.

Risks can affect entire asset classes. Changes in the inflation rate can make corporate bonds more or less valuable, for example, or more or less able to create valuable returns. In addition, changes in a market can affect an investment’s value. When the stock market fell unexpectedly and significantly, as it did in October of 1929, 1987, and 2008, all stocks were affected, regardless of relative exposure to other kinds of risk. After such an event, the market is usually less liquid; that is, there is less trading and less efficient pricing of assets (stocks) because there is less information flowing between buyers and sellers.

As you can see, the link between risk and return is reciprocal. The question for investors and their advisors is: How can you get higher returns with less risk?

KEY TAKEAWAYS

- There is a direct relationship between risk and return because investors will demand more compensation for sharing more investment risk.

- Actual return includes any gain or loss of asset value plus any income produced by the asset during a period.

- Actual return can be calculated using the beginning and ending asset values for the period and any investment income earned during the period.

- Expected return is the average return the asset has generated based on historical data of actual returns.

- Investment risk is the possibility that an investment’s actual return will not be its expected return.

- Investment risk is exposure to

- economic risk,

- industry risk,

- company- or firm-specific risk,

- asset class risk, or

- market risk.

Check Your Understanding

Answer the question(s) below to see how well you understand the topics covered in this section. This short quiz does not count toward your grade in the class, and you can retake it an unlimited number of times.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.

Candela Citations

- Individual Finance. Authored by: Anonymous. Provided by: Anonymous. Located at: http://2012books.lardbucket.org/books/individual-finance/s16-03-measuring-return-and-risk.html. License: CC BY-NC-SA: Attribution-NonCommercial-ShareAlike