Learning Outcomes

- Identify activities and estimate total indirect costs for each

Activities are events, units of work, or tasks that have a specific goal.

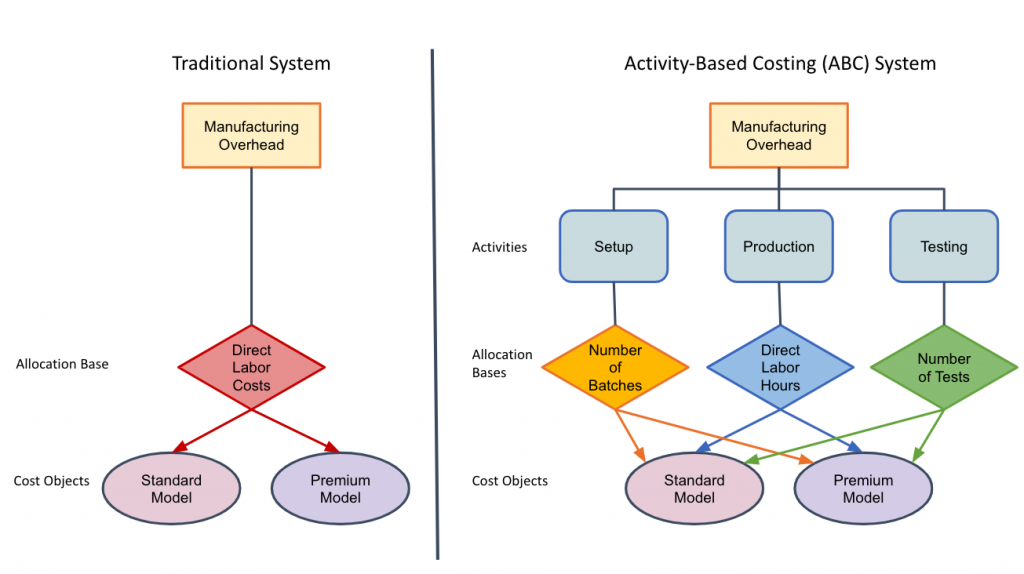

In a factory, ABC identifies activities within the manufacturing process that occur repeatedly, such as purchasing, production scheduling, setups, moves, inspections, testing, clean-ups, and invoicing. Each activity has its own activity base to measure usage. The following list matches common activities of a manufacturing company with their respective activity bases.

| Common Activities | Activity Bases |

|---|---|

| Accounting Accounts Payable Payroll Purchasing |

Number of accounting reports Number of invoices processed Number of payroll checks processed Number of purchase orders processed |

| Customer Service | Number of customer returns |

| Human resources | Number of employees |

| Production setup | Number of setups |

| Quality control | Number of inspections |

| Shipping | Number of sales orders processed |

Remember that activities are different than departments. A department, such as production, may have many activities, such as setup, assembly, finishing, packaging, and quality testing. It is also possible that an activity could cross traditional departmental lines. For instance, there could be a safety department, a maintenance department, and a production department, where the activity of assembling an item may involve personnel and equipment from each of those.

Let’s assume for purposes of this lesson that the production function of Yore Company is divided into two departments: assembly and finishing. The assembly department is mostly automated and the finishing department is labor-intensive with humans doing most of the work by hand. However, without regard to departments, managerial accountants using ABC would identify significant activities, such as setup, production, and quality assurance. Each of these activities has a unique cost driver. For instance, production could be assigned a cost driver of labor hours, setup could be assigned a cost driver of batches, and quality assurance could be assigned a cost driver of # of inspections.

Here is a bit more detail from the accounting department to add in more information about indirect costs for each:

| Description | Total |

|---|---|

| Subcategory, Assembly Department Budget | |

| Supervisory | $ 13,200 |

| Depreciation | 67,800 |

| Building costs | 60,000 |

| Assembly | Single Line$ 141,000 |

| Single Line | |

| Finishing Department Budget | |

| Inspection staff | $ 12,000 |

| Supervisory salaries | 11,400 |

| Building costs | 23,600 |

| Finishing | Single Line$ 47,000 |

| Single Line | |

| Total overhead | Single Line$ 188,000Double line |

There are probably some intermediate allocations going on here. For instance, building costs may be allocated to each department based on square footage, and supervisory salaries may be allocated to each department based on hours worked or number of employees.

Now, using Activity Based Costing, we will be asking the accounting department to accumulate costs slightly differently. Most accounting systems should be able to do both–report costs on a departmental basis AND on an activity level, but those costs will have to be coded correctly as they are entered. Let’s say that, working with the financial accounting staff, you are able to determine the following:

| Description | Cost | Setup | Assembly | Quality Assurance |

|---|---|---|---|---|

| Subcategory, Assembly Department Budget | ||||

| Supervisory | $ 13,200 | $ 10,000 | $ 3,200 | $ – |

| Depreciation | 67,800 | 18,200 | 49,600 | – |

| Building costs | 60,000 | – | 60,000 | – |

| Assembly | Single Line$ 141,000 | Single Line$ 28,200 | Single Line$ 112,800 | Single Line$ – |

| Single Line | Single Line | Single Line | Single Line | |

| Subcategory, Finishing Department Budget | ||||

| Inspection staff | $ 12,000 | $ – | $ – | $ 12,000 |

| Supervisory salaries | 11,400 | – | 8,200 | 3,200 |

| Building costs | 23,600 | – | 20,000 | 3,600 |

| Finishing | Single Line$ 47,000 | Single Line$ – | Single Line$ 28,200 | Single Line$ 18,800 |

| Single Line | Single Line | Single Line | Single Line | |

| Total overhead | Single Line$ 188,000Double line | Single Line$ 28,200Double line | Single Line$ 141,000Double line | Single Line$ 18,800Double line |

The assembly department costs are the same under both systems, but that is just a coincidence. That would never happen in reality. The finishing department includes the final stages of assembly and the inspections stage. Under activity based costing, we would break that out (in this case into our new “activity” of assembling and an activity called Quality Assurance. Also, some of the assembly department costs are now classified as an activity called Setup.

Again, in an actual business, there would be more departments and more activities and more product lines, but we are keeping this example as simple as possible.

Before we examine how to apply these different methods to determine the cost of our product, let’s review the definition of an activity and how that is different from a department.

Practice Question

Candela Citations

- Allocating Overhead using ABC. Authored by: Joseph Cooke. Provided by: Lumen Learning. License: CC BY: Attribution

- Traditional System vs. ABC Costing System. Provided by: Lumen Learning. License: CC BY: Attribution